Digital Finance for Climate Resilience: An Urgent Opportunity for Startups and Stakeholders in Emerging Markets

As the international community is busy negotiating carbon emissions, millions of people around the world are already experiencing the real-world impacts of climate change: from lasting droughts and soaring temperatures, to more frequent wildfires and other extreme weather events. The consequences of a rapidly warming climate are no longer hypothetical scenarios or predictions – they are a global reality, and they’re getting worse.

The effects of these impacts are not evenly distributed; they are concentrated among those who are dependent on natural resources, the poor and vulnerable, and those in particular geographies, like coastal regions. Many of these populations also lack access to solutions and resources that might mitigate their greater exposure to climate-related threats and help them to manage their impact. In sum, the people who are most exposed to climate change impacts are also those who are least able to cope.

The Opportunity in Climate Resilience Solutions

While this imbalance is troubling, it also points to an opportunity. Climate resilience solutions can help vulnerable people anticipate, adapt to and build resilience to the physical impacts of climate change, if we can package those solutions into products and services that are accessible and affordable. But unfortunately, creating this access is not straightforward because vulnerable communities are difficult to serve, as they are largely poor, remote and excluded.

Fortunately, inclusive tech providers have made inroads into these markets with pioneering models that serve exactly these populations. Leveraging growing connectivity and cheaper mobile devices, many of these models use smartphone access, satellite data and other technologies to give vulnerable people access to a range of goods and services. For example, tech-powered biometric systems have helped financial service providers overcome identification requirements that may have otherwise excluded those without formal records, or required costly in-person verification. Similarly, digital payment rails – like mobile money in East Africa and UPI in India – have given those without experience with formal financial services greater access to a wide range of products and services, even when last-mile distribution channels are weak.

The DF4CR Solution Space: How Digital Finance Can Power Climate Resilience

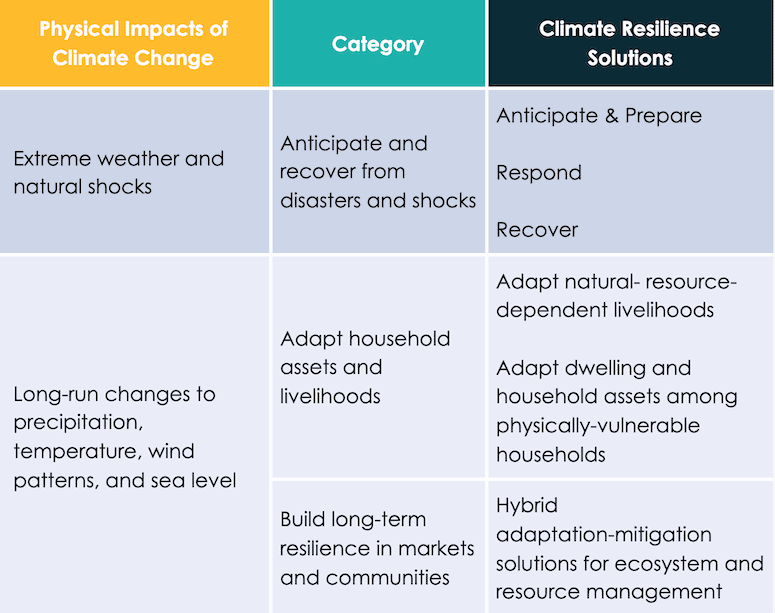

Given the success of digital financial services innovations in reaching last-mile populations, we at BFA Global see an opportunity for digital finance to power greater climate resilience. We convened a task force of climate and financial services experts – including the World Resources Institute, CGAP, PayPal, the Better than Cash Alliance and the U.N. Race to Resilience – to articulate the opportunity of digital finance for climate resilience (DF4CR). Together, the taskforce developed the solutions map presented below to provide an actionable way for stakeholders to understand the DF4CR opportunity, and to target the concrete solutions that can build climate resilience among vulnerable people in emerging markets.

This framework outlines the DF4CR solutions space, which consists of the categories of solutions that can make vulnerable communities more resilient to the physical impacts of climate change, and that can be made viable by digital finance enablers. At a high level, we identified three categories of solutions: 1.) solutions that help vulnerable people anticipate and recover from natural disasters; 2.) solutions that enable households to adapt their livelihoods and assets to ongoing changes in weather; and 3.) solutions that help build long-term climate resilience for communities and markets. The map provides examples of types of solutions that fall into each category; these are not exhaustive, but serve as valuable illustrations

In the category of “Anticipate and Recover from Disasters,” we highlight three distinct groups: Anticipate and Prepare, Respond, and Recover. The Anticipate and Prepare group includes a number of early warning and preparation products, as well as solutions for disaster-proofing homes and assets. The Respond group includes digital humanitarian response infrastructure and services like digital cash transfers, and emergency access to essential services. The Recover group focuses on recovery efforts via insurance, like those provided by fintech startups like Pula, Harvesting and Apollo Agriculture, which bring crop and livestock insurance to smallholder farmers.

In the category of “Adapt Household Assets and Livelihoods,” we highlight innovations that prepare households for ongoing changes in weather and climate, typically with an eye to leveraging renewable energy and other mitigation technologies. The first group is focused on livelihood adaptations for people dependent on natural resources for income, including climate-smart agricultural practices such as drought-resistant seed, drip irrigation and land leveling. This group also includes forecasting and advisory services like those provided by FarmApp in Colombia and Digifarmz in Brazil. The second group includes similar adaptations, but for dwellings and assets – such as improvements to ventilation, and water access and management. For example, Kwangu Kwako in Kenya helps vulnerable families with affordable housing that is better-adapted to climate change.

Lastly, in the category of “Long-term Resilience for Markets and Communities,” we point to solutions that enable climate-resilient livelihoods at the ecosystem or market level. Since long-term resilience is a vast ambition, we focus only on solutions for climate-vulnerable value chains. These can include marketplaces for sustainable agriculture and fisheries like Abalobi, recycling centers, and data/traceability technologies that are needed to enable carbon marketplaces.

Moving Toward Climate Resilience in Emerging Markets

While the scale of the climate change crisis can make meaningful action difficult to imagine, we hope this framework gives digital finance and climate stakeholders a place to begin in allocating more resources toward resilience solutions in emerging markets. To that end, we have also identified eight investment theses to guide investors and startups in building this sector. We would welcome input from the global development and climate change adaptation communities as we search for innovators and startups to feature and support. Please submit startup examples via this page.

In addition, the taskforce is now working on a Framework for Action – a roadmap to guide key stakeholders in catalyzing the ecosystem for DF4CR – to be launched at a webinar on Tuesday, October 26 (register here). We are looking for collaborators and contributors who would like to be featured in that framework as case studies, thought leaders and supporters. We are also currently seeking startups working in the DF4CR space for our next Catalyst Fund cohort. Interested companies seeking investment can add themselves to our database here.

Malika Anand is Head of Insights and Learning for BFA Global’s Catalyst Fund.

Photo credit: Kate Holt / AusAID

- Categories

- Environment, Finance, Telecommunications