Financial Inclusion for Rural Youth Starts with Adults

The challenge of youth unemployment continues to garner headlines. Recently, The New York Times described the demographic challenge under the headline, “The World Has a Problem: Too Many Young People.” Such headlines have galvanized interest in youth and led governments and donors to re-focus their efforts on employing this growing population. Youth-inclusive financial efforts have expanded as well, aimed at providing youth with the credit and savings services necessary to facilitate their “earning and learning.”

But where should these initiatives begin – at preparing youth, reforming institutional offerings, revising policies, or somewhere else?

Most work to date has focused on urban youth. In an effort to increase learning on how best to serve rural youth, Making Cents International implemented the Rural Youth Economic Empowerment Project (RYEEP) in Egypt, Morocco, Tunisia and Yemen. (For the purpose of RYEEP, youth were defined as those between the ages of 18 and 35.) Funded by the International Fund for Agriculture Development with additional in-kind and technical contributions from Silatech, RYEEP tested five different approaches to overcome both the typical challenges of rural finance – insufficient infrastructure and dispersed populations – and the specific challenges facing rural youth – including poor quality education and cultural or gender norms that discriminate against them as economic actors.

By the end of the three-year project, RYEEP pilots achieved remarkable outreach, providing savings or credit services to approximately 20,543 youth and non-financial supportive services to 14,252 youth. In the process, the project deepened learning along five major research topics:

- Adapting and developing effective financial products for rural youth

- Determining the appropriate level and delivery system for supportive non-financial services

- Linking products or institutions to facilitate movement from informal to formal structures

- Using technology to lower costs and provide youth with alternative forms of finance

- Designing innovative approaches for scaling products in rural environments

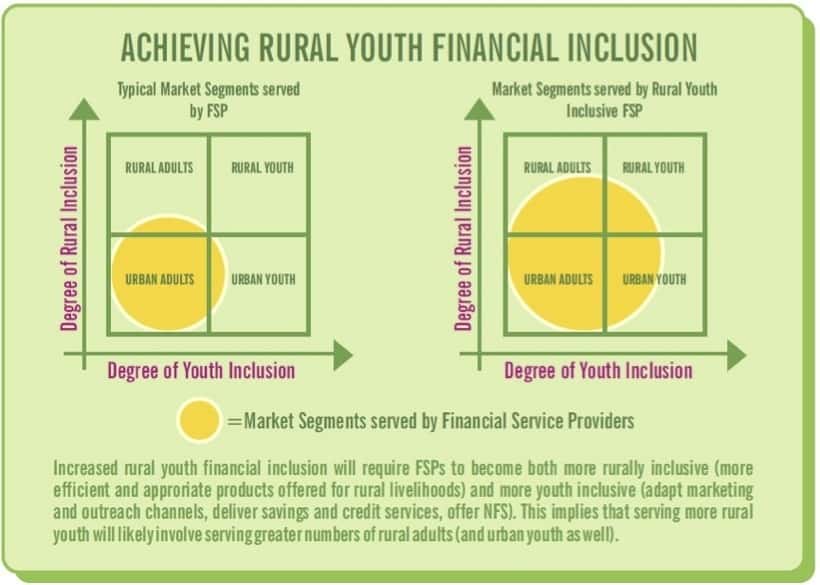

But perhaps the most important insight was at the strategic level. The five pilot projects took different approaches to serving youth – from sequential strategies that focused on rural adults first, then youth; to simultaneous strategies for both adults and youth; to youth-first approaches. All of the pilots were successful in increasing youth outreach. However, the most sustainable and scalable approaches leveraged infrastructure and innovations that had been used to serve adults or developed it to serve both adults and youth at the same time.

These approaches were more sustainable because they addressed the overarching problems of rural finance first – weak infrastructure and low population density – by focusing on developing branch networks or using digital finance platforms, before turning to the youth-specific issues of poor quality education, dismissive bank attitudes toward younger clients, and little access to collateral. This strategy contrasts with urban youth strategies, where the existing financial infrastructure is sufficiently strong to enable a youth focus from the outset.

The implications of this finding are shown in the graph below that shows how a sustainable rural youth growth strategy starts from those who are easiest to serve and works outwards.

For rural youth, that means that financial institutions should leverage investments and efficiencies from serving adults before turning to youth. The findings from our five RYEEP pilot projects led us to conclude that solving the problem of financial inclusion begins not with learning how to serve youth but how to serve their parents.

Learn more about the overall project learning and specific case studies on Making Cents’ website or directly:

Summary: Findings from Five Youth-Inclusive Rural Finance Pilot Projects

Case Study 1: Youth Savings Groups in Egypt

Case Study 2: Enterprise Loans for Rural Youth in Yemen

Case Study 3: “Savings for Tomorrow” in Morocco

Case Study 4: Youth-Inclusive Value Chain Finance in Tunisia

Case Study 5: Start-Up and Expansion Lending for Rural Youth in Tunisia

Tim Nourse is president of Making Cents International.

- Categories

- Uncategorized

- Tags

- financial inclusion, youth