Financial Inclusion Under the Microscope: Which countries scored highest in Accion’s “Global Microscope 2014”?

If there’s one thing we’ve learned in taking a close look at financial inclusion efforts around the world, it’s that context matters. That’s why we are excited to be part of the team releasing the Global Microscope 2014: The Enabling Environment for Financial Inclusion. The Microscope is carried out by the Economist Intelligence Unit (EIU) with sponsorship and guidance from the Multilateral Investment Fund of the Inter-American Development Bank, CAF (the development bank of Latin America) and Citi. The Microscope evaluates the environment for financial inclusion in 55 different countries and provides powerful signals to policymakers in each country on their progress. Which countries topped the list and which have the most room to grow?

We’ll tell you, but first, it’s important to know what the results mean. Each country inspected in the Microscope is assessed on 12 indicators that consider best practices in national regulatory environments and institutional support for providers serving clients at the base of the pyramid. Indicators range from government support for financial inclusion, to supervision of microfinance and other financial products, the status of credit reporting, regulations governing mobile banking and, last but not least, consumer protection.

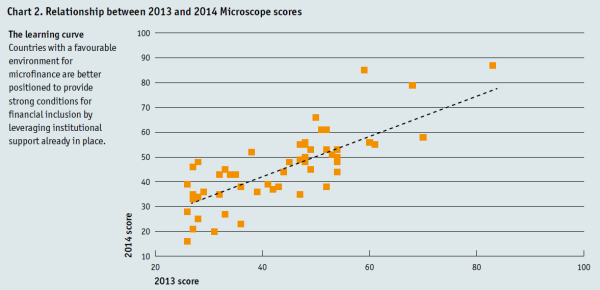

This year is an important one in the publication’s eight-year history because the focus shifted from microfinance to the environment for financial inclusion, a process that involved adapting the framework to account for today’s diversity of providers and products. What we were surprised by, however, was just how little a difference this made in the rankings. We charted last year’s results on the microfinance environment against this year’s results on the financial inclusion environment and we found a very high correlation between the two (see figure below). Environments that are enabling for microfinance are often environments that are enabling for financial inclusion. Six countries from last year’s top 10 were in this year’s top 10.

So, who leads the pack? Here’s the list of the top 10 countries and their scores (on a scale of 0 to 100).

1) Peru — 87

2) Colombia — 85

3) Philippines — 79

4) Chile — 66

5) Mexico and India (tie) — 61

7) Bolivia and Pakistan (tie) — 58

9) Cambodia and Tanzania (tie) — 56

There were three very clear champions: Peru, Colombia, and the Philippines, whose scores are well above the next-ranked country, Chile. Peru and Colombia performed strongly across the board, scoring in the top five on nearly all indicators. The Philippines’ inclusion environment ranked well in part due to its capable regulator, optimal credit regulation, and effective dispute-resolution mechanisms.

The wide range of performance is notable. Top-scoring Peru secured 87 out of a possible 100 points, while lowest-ranked Haiti only managed 16, and there are countries spread rather evenly throughout the whole scoring distribution. This reveals a very wide range of attention to and progress on financial inclusion across the world. This range is borne out by the finding that a third of countries have active national financial inclusion strategies with targets, a third have strategies that remain vague or patchy, and a third have not made any formal commitment to financial inclusion.

Regionally, both Latin America and the Caribbean and East and South Asia score well. While the Middle East and North Africa region had the lowest regional average score, low scores are present among countries in several regions: Democratic Republic of the Congo, Madagascar, Egypt, Yemen, and Haiti.

East and South Asia and Sub-Saharan Africa are the leading regions in regulation for electronic payments. Kenya and Tanzania in particular stand out for their strong regulation conducive to the growth of mobile payments, and Bangladesh, Pakistan, and Sri Lanka for their effective e-pay infrastructure.

The Microscope found that countries that had strong institutional support – credit reporting, client protection, accounting standards – often performed very well overall, and countries that had weak institutional support performed poorly. Countries at the bottom of the rankings performed especially poorly on measures of institutional support.

The Microscope report, with its country profiles, provides a rich source of information for further research. It also provides a stimulus for policymakers to focus on areas for improvement and to look to the leaders for inspiration and example.

For more detail, including country breakdowns and rankings, you can download the report here.

Editor’s note: This post was originally published on the Center for Financial Inclusion’s blog. It is cross-posted with permission.

Sonja E. Kelly is a Fellow at the Center for Financial Inclusion at Accion, conducting research on financial inclusion with special attention to vulnerable populations.

- Categories

- Uncategorized