Can Agile Fintech Startups Be the Answer To Food Insecurity During the COVID-19 Crisis?

COVID-19 lockdowns have threatened small and medium enterprises (SMEs) and vulnerable families around the world. SMEs in emerging markets are especially at risk, as they depend on fragmented supply chains and informal labor and inventory arrangements. This means they lack recourse when agreements go unfulfilled, and they don’t have financial safety nets to bolster their resilience.

But even as aid agencies can find it difficult to implement rapid-response projects due to weak logistical and information infrastructure in urban settlements, inclusive fintech startups that are embedded in these communities are offering reliable, cost-effective and targeted channels for reaching needy beneficiaries.

Catalyst Fund portfolio company Sokowatch has developed a quick, verifiable and effective way to bring food security to vulnerable families in Kibera, Nairobi. The company runs an e-commerce platform that enables these SMEs to order products (via SMS or mobile app) directly from fast-moving consumer goods suppliers, and receive free same-day delivery. The startup also leverages SMEs’ purchasing data to provide them with rotating inventory credit, as well as product mix recommendations to maximize their earnings. The startup now serves over 16,000 dukas (retail SMEs) across Kenya, Rwanda, Tanzania and Uganda.

The team recently piloted an innovative e-voucher program that leveraged this network of SMEs to address food insecurity among 160 families and 12 dukas in Kibera’s slums. In just one month, the program delivered significant results in reducing food insecurity and boosting dietary diversity among vulnerable households (as described below). It also significantly boosted the income of participating dukas. These enterprises reported a median revenue of Ksh 7,000 before the pandemic, which dropped to Ksh 1,500 after lockdown began. By the end of the pilot, their median revenue had rebounded to Ksh 6,500.

The e-voucher program builds on best practices in the food aid/cash transfer fields, giving households purchasing choice (thereby mimicking the advantages of cash), but focusing benefits on food security, much like food aid. Furthermore, the e-voucher system provided much-needed support to precarious SMEs, without disrupting market forces.

COVID-19 has left households and SMEs vulnerable

Food security across Kenya, and specifically in urban slums like Kibera, was already precarious, and it has been amplified by COVID-19 and its associated lockdowns. A 2016 World Food Program paper found that almost one in three households in Kenya reported food shortages. This suggests that households may have already been food insecure before the pandemic, and are likely to become more insecure as it progresses. Informal settlements like Kibera are especially vulnerable, as recent surveys conducted by BFA Global suggest informal and daily-wage income has fallen dramatically in recent months.

SMEs are also bearing the brunt of the economic impact from COVID-19. The Organisation for Economic Co-operation and Development and International Labour Organization note that SMEs will find it difficult to sustain business operations under lockdown conditions. BFA Global’s own research has found that SMEs need to adopt drastic workarounds to survive during the pandemic, and recent surveys found that businesses in Kenya would only be able to sustain operations for 6.5 weeks if their revenue fell by half.

Mechanics of the e-voucher program

In crowded, informal settlements, it can be difficult for aid providers to identify and reach needy beneficiaries with relief payments or other sources of support. There are no fixed addresses, and the settlements have poor documentation and weak logistics infrastructure. While these communities are inscrutable to outsiders, inclusive fintech startups like Sokowatch are deeply embedded in them, and have existing relationships with the households and SMEs, often via mechanisms for digital transfers/payments.

When the lockdowns came into force, Sokowatch noted the immediate impact on the dukas in their network, as well as the families they served, which suggested households were making severe cuts in their food consumption. The startup partnered with Catalyst Fund and Uweza Foundation to develop this e-voucher program as a way to quickly deploy resources to the dukas and to the families in their communities.

The pilot started with Uweza Foundation helping the Sokowatch team to identify families in need. Those families received an SMS each week for one month. The SMS contained an e-voucher that could be redeemed for selected items at an indicated duka in the Sokowatch network. At the shop, the recipients simply needed to indicate the products for which they wanted to redeem their e-vouchers. The shopkeeper then entered the products and e-voucher code into the Sokowatch app, after which the beneficiary received a One Time Passcode (OTP) and SMS receipt, listing the items to be collected. If the receipt was correct, the beneficiary shared the OTP with the shop owner, who then entered it into the Sokowatch app and was instantly credited for the items. Prices for products are fixed within the app, so the value of the voucher was constant vis-a-vis the products.

The program leveraged Sokowatch’s direct distribution channels and visibility into duka operations to reach households in need of support at a low cost, while also maintaining and reinforcing duka businesses, which provide vital income to their owners.

It benefited SMEs by increasing demand in their shops. Not only did the shops earn a margin on the items redeemed for e-vouchers (as Sokowatch credit), but they also stood to benefit if beneficiaries purchased additional products, aside from the voucher items. Shopkeepers were still financially responsible for the inventory they purchased, but they also had the assurance of demand from voucher recipients, so the risk of purchasing inventory associated with the vouchers was reduced.

Impact on the food security and financial health of low-income households

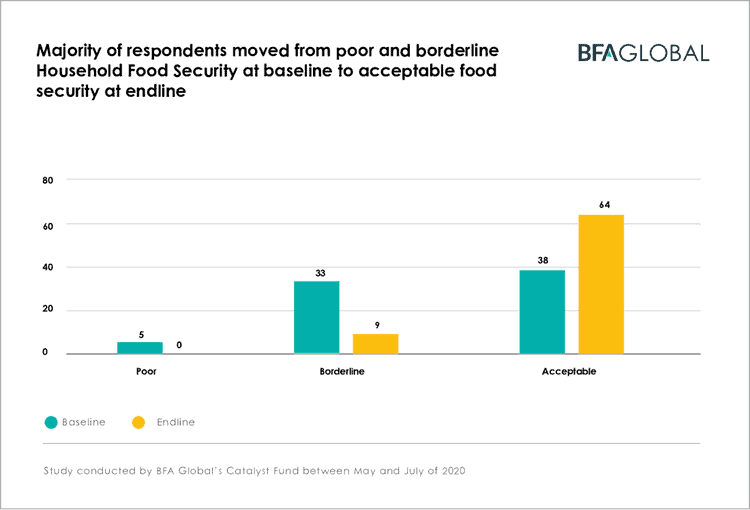

The program’s impact on food security was significant and immediate. Household Food Consumption Scores improved dramatically; while 47.4% of households fell into the severely insecure category at the beginning of the pilot, and only 2.7% did so at the end. In contrast, 0% were food secure at the start, while 61.6% were food secure by the end of the pilot.

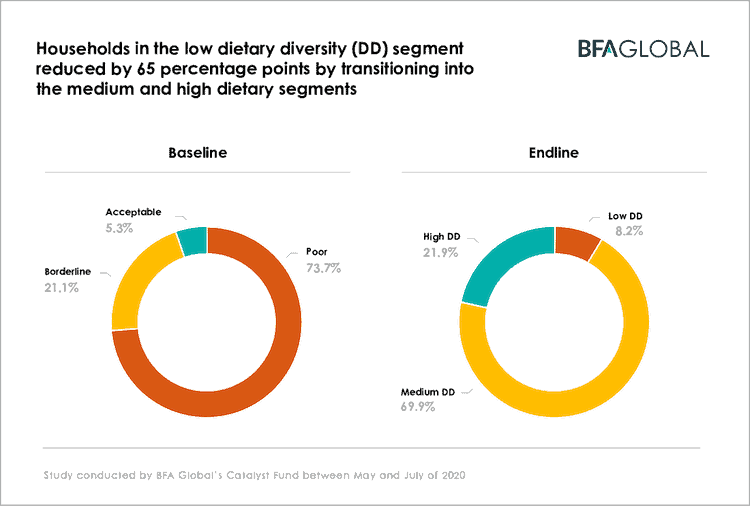

Similarly, the proportion of households experiencing low dietary diversity (as per the Household Dietary Diversity Score) dropped dramatically, with 65% of households moving up from low dietary diversity to medium or high diversity, meaning that households moved to consuming more types of foods. A more diverse diet means that nutrition is more likely to be complete.

Not only were the households better off in terms of food security, their financial security also improved. The households were able to save during the period, instead of continuing to spend their savings as income was reduced. At the end of the program, 34% of the households said they had been able to put money aside for emergency funds – an increase of 30% from the baseline. Overall, 76% of the respondents said that the voucher program had improved their financial health significantly.

Fintech startups: a promising channel for aid and relief

This project demonstrates the significant potential that inclusive fintech startups have to serve as partners and conduits for relief programs, in partnership with NGOs and/or governments. These startups are embedded in underserved communities, know how to identify vulnerable families and can reach them in low-cost, reliable, verifiable ways. The program was able to leverage Sokowatch’s existing distribution operations and payment channel (developed with Catalyst Fund’s acceleration support) to virtually costlessly extend relief to vulnerable families, while also providing financial support to dukas. Today, Sokowatch is looking for additional partners to extend and scale the program to continue serving vulnerable families in the communities they serve.

Malika Anand is Head of Insights & Learning at the Catalyst Fund, Michelle Hassan is a Principal Consultant at BFA Global.

Photo courtesy of IFPRI -IMAGES.

- Categories

- Coronavirus, Finance