It Takes a Village to Build a Business – Lessons Learned From a Fintech Accelerator in Mexico

Over the past two years as financial technology (fintech) startups have exploded around the United States, a slow storm has been building in our neighbor to the south. Necessity is the mother of invention, therefore it’s no surprise that Mexico, with one of the largest underbanked populations in the region, is looking to fintech to address this widespread issue. Financial inclusion has been an important topic in Mexico as it is a key enabler to reduce poverty and boost economic prosperity. While the numbers have improved, there continues to be a large gap in access to financial services. According to the 2014 World Bank Global Findex, only 39 percent of Mexico’s population over 15 years old has a bank account, and only 10 percent has received credit from a formal institution. Yet the number of individuals who have saved informally (through friends or family) has tripled over the past three years from 5 to 17 percent, and those who informally received loans have nearly doubled from 14 to 26 percent.

Mexico’s growing demand for financial services, emerging entrepreneurial ecosystem, and developing technology talent pool contributed to making the country an ideal choice for Accion Venture Lab’s first investments in Latin America: Clip, a mobile point of sale (mPOS) tool that enables credit card acceptance; Salud Facil, a health care loan facilitator; and Konfio, a digital credit platform for small and medium enterprises (SMEs). These investments are only the start of our involvement; Mexico’s burgeoning fintech space compelled us to team up with Village Capital and the MasterCard Center for Inclusive Growth to organize and promote a financial technology accelerator in February to April of this year.

This was the first time Venture Lab has been an official partner in an accelerator program. As early-stage investors, we were curious to understand how we and other investors could add value in this arena of ecosystem and company building. Overall, from analyzing the cohort applicants to coordinating final pitch presentations, we learned a great deal about local market challenges and catalyzing financial inclusion in one of the markets that needs it most.

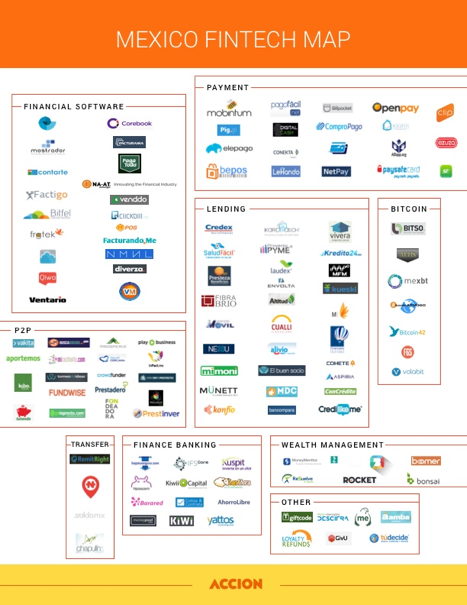

The objective of the accelerator program was clear: to find and assemble the 12 best early-stage fintech companies in Mexico, and through a three-month program, provide them with the mentors and tools they need in order to take the leap from betas to scalable businesses. We knew there would be an interesting number of startups working in this space, and were even more encouraged when we found, through our initial market scan, about 330 fintech companies operating in Mexico. Of those 330, 30 percent were lending or payment companies targeting SMEs and the rest a mix of financial software, wealth management, bitcoin payment and remittance startups. Among our final 85 accelerator applicants, we saw a large concentration of lenders, including a strong group of peer-to-peer players. This validated our original thesis that the demand for better financial services is real, and that there are a variety of startups trying to solve these issues.

(Above: participants in the accelerator.)

Given the positive response to our call for applications, we were excited to choose the final group of 12 companies to participate in the accelerator program. We based our selection on five main company characteristics: team, innovation, traction, scalability and business model. These companies were concentrated in the remittance, payments, savings and lending sectors. Some of them had a few customers or were launching pilots, while others had hundreds of clients and were focused on continued growth. All of the companies had operations in Mexico and at least one full-time team member.

The final 12 startups were:

- Aspiria, an SME lender;

- Banlinea, a financial software company that digitizes the loan application process;

- BillPocket, which provides mPOS tools for SMEs;

- Chapulin, a money transfer service to Mexican immigrants in the United States;

- ComproPago, which enables e-commerce platforms to accept cash payments;

- Credilikeme, a consumer loan platform for millennials;

- El Buen Socio, which provides affordable loans with flexible payment plans to socially and environmentally impactful entrepreneurs;

- Kiwi, a health savings platform;

- Netero, an international money transfer company;

- Volabit, an online wallet for Bitcoin and pesos that users can deposit into with cash at corner stores;

- yotepresto.com, a peer-to-peer lending platform;

- Zave App, which helps people build savings by making saving easy and fun.

A key challenge in facilitating the accelerator was ensuring a space for collaboration and openness. Because of this, Village Capital and Venture Lab intentionally decided to exclude direct competitors in the cohort. This may seem counterintuitive, but we found that by excluding direct competitors, we allowed companies to cultivate more meaningful relationships and share honest feedback on their peers’ progress. Many accelerator participants agreed. Hannah Kim from Volabit commented, “The huge value that I see from being here (in the accelerator) is sharing and collaborating with other companies in the fintech space. … Seeing each other as partners, friends and supporters is tremendously important in these programs.” Similarly, Luis Roberto Perez from Credilikeme noted that, “In fintech, there is more value in collaboration and creating ecosystems between potential competitors than being restrictive or secretive. … With more competition, more awareness of the general product grows, and it pushes us to find our true value proposition.”

(Right: Fintech companies in Mexico. Image credit: Alejandra Aranguren.)

For any early-stage company, understanding the end client is extremely important to define and refine the growth path of a startup. In running this accelerator program, like a startup, we also needed a deep understanding of the needs, behaviors and wants of our participants. We assessed these by conducting a variety of pre-program surveys and calls alongside Village Capital. Responses from the cohort mentioned several needs: “We need to better understand how to acquire customers, and acquire them quickly,” wrote one. Another participant wrote, “We would like advice on sales and distribution channels for the company, and how to structure them in order to take advantage of our resources.” This gave us a fascinating insight as investors, to not only prepare for the content creation and to invite value-add mentors, but to validate some of the things that we need to be particularly thoughtful about when analyzing investment opportunities.

Similarly, seeing these companies struggle with tough questions and decisions throughout these three months helped us learn more about how entrepreneurs in Mexico think, who is out there hustling, and who could be our next investment. It was also a special chance to get to know CEOs outside of our typical investment process, which is often characterized by an uncomfortable “sizing up” evaluation on both sides, and a feeling of power imbalance. In this accelerator context, we’re all genuinely pulling in the same direction and want everyone to succeed, and we can find ways to help without raising expectations for an investment. We also got an insider’s view to building a startup in Mexico: Through these close relationships, we heard CEOs open up about the difficulties of feeling alone or isolated, and the fears and uncertainties that come with trying to build a business around your passion. In this program, we saw that these startup founders really benefited from a “village” of supporters, cheerleaders and new friends who were experiencing the same highs and lows. As one of the CEOs in the accelerator wrote, “I see my cohort fellows sitting in the front row, driven entrepreneurs whom I’ve come to respect and admire, they smile at me. We no longer care who wins. We all know who wins. We all do.”

Overall, this first-time experience of seeing what an accelerator program looks like from the inside was a valuable experience for Venture Lab. As early-stage investors, we were able to get more visibility into the process before the sleek final pitch deck. We also got a glimpse into the details that make the entire program function: the changes in schedule, the happy hours, the lost sound system, the rich mentor interactions, the efforts to rally motivation. This combination of messy and exciting pieces led to a rich experience for our team, and made us more empathetic investors, mentors and ecosystem village supporters.

Editor’s Note: This article was voted by readers as one of NextBillion’s Most Influential Articles of 2015.

Jackie Hyland is a senior investment analyst with Accion Venture Lab, supporting the team’s global deal activity and portfolio engagement.

Photo courtesy of PresidenciaRD.

- Categories

- Uncategorized