Leveraging India’s Digital Transformation: Three Lessons for MFIs

The Indian government’s surprise decision in November to demonetize two key currency notes – the Rs. 500 (about US$7.4) and Rs 1000 (about US$15) – pulled 85 percent of the currency used out of circulation. The primary goal was to root out so-called “black money” (funds that were illegally obtained or not declared for taxes). While it will likely put a check on black money in the medium term, it has caused a short-term crunch as 90 percent of transactions across India depend on cold, hard cash. Especially hard-hit are the poor, who purchase, save and borrow in small denominations.

Equally affected are microfinance institutions (MFIs), which rely heavily on cash to serve their poor clientele. As loan repayments in the Rs. 1000 and Rs. 500 denominations were discontinued, MFIs were forced to halt loan disbursements. Some MFIs have also considered rescheduling loans if the currency flow does not improve sufficiently.

Despite these significant pressures, the current situation is ripe for MFIs to begin adopting digital financial services and transitioning to cash-lite operations. In the long-term, this could benefit hundreds of thousands of India’s poorest citizens who remain outside the financial system, particularly in areas where banking infrastructure is weak or nonexistent.

India’s MFIs have been central to expanding financial inclusion, creating an opportunity for women to enter the financial sector and enabling many poor clients to manage emergencies, raise their incomes and improve living standards. In addition, several recent initiatives launched by the government of India have made financial products and services more accessible to the less privileged.

But there is still far to go. Financial inclusion remains a dream for more than 506 million people, and a large portion of the rural segment still remains unbanked.

The key reasons for continued financial exclusion include: 1) lack of last mile connectivity and awareness; 2) weak infrastructure; 3) a limited trained field force in rural areas; 4) low client financial and mobile literacy; and 5) insufficient products that are relevant to the needs of poor people.

To date, only a few MFIs have experimented (sporadically) with integrating digital financial services into their core operations. The high cost of digital payments, poor digital literacy among their target clientele and an inadequate digital payments infrastructure are among several barriers facing MFIs.

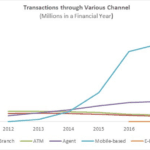

This is certainly not unique to microfinance. Though the use of digital payments in India has increased rapidly in past two years, the availability of transaction devices like point-of-sale (POS) terminals still lags behind other comparable economies such as Brazil, Russia and China.

Many experts believe, however, the recent demonetization will spur more small and medium-sized businesses to integrate into the formal economy and hence accept digital payments more readily. This will eventually increase the volume of digital payments and lower transaction costs for MFIs as digital financial service providers penetrate more deeply into the rural hinterlands through an increased merchant and agent base.

In the meantime, many government entities and private companies are trying to quicken the pace of change. For example, various government organizations have begun airing public service advertisements, conducting literacy camps and converting their own transaction systems to accept digital payments.

So how can Indian MFIs take advantage of these changes?

Grameen Foundation India has worked with several MFIs to transition to a digital financial services platform, using both an outsourced repayment system and a business correspondent model for mainstream banks.

Drawing on that experience, we believe MFIs should keep a few key lessons in mind:

- Conduct a thorough analysis of your business requirements before you select a digital financial services provider – and ensure the provider is compatible for your needs. This sounds like a no-brainer, but we have often seen pilots fail because of unrealistic expectations between partners.

- Do not discount the value of effective change management. Adopting digital financial services will affect every part of your organization. Change management plays an important role in aligning the staff to the larger organizational strategy and most importantly alleviates their fears about job security and their role in the “new” organization.

- Pay close attention to client education. Given the scale at which this transition needs to be adopted at the client level, MFIs need to apply user-centric approaches to design and deliver client education that supports the transition to digital financial services. Special attention must be paid to the inclusion of poor women, who are less likely than their male counterparts to own or have ready access to a mobile phone. It will also be important for MFIs to work with their clients to raise the level of digital financial literacy and develop products that are straightforward to use.

India’s digital transformation will not happen overnight, but MFIs need to get ready for the change as phones become increasingly accessible in once-remote communities. Today, roughly 38 percent of the rural population, including children and senior citizens, are rural mobile phone users – an increase from 22 percent in 2010. As the number keeps rising, so too do the possibilities of digital financial services that benefit the poor.

Chandni Ohri is CEO and Raunak Kapoor is project manager, Digital Financial Services, at Grameen Foundation India.

Photo: Microfinance institutions play a critical role in helping poor communities transition to a cash-lite society. Courtesy of Grameen Foundation

- Categories

- Technology