Formal Insurance for Informal Labor: How Microinsurance Can Cover Young Workers in the Gig Economy

The gig economy is a growing source of employment for youth in emerging markets. To take just one example, a 2019 report on Kenya’s gig economy estimated that its size is US $109 million, and that it employs over 36,000 workers. The report further states that based on current investment levels, the sector is projected to grow by about 32% over the next five years, bringing its value to US $345 million and its total employment to over 93,000 workers. These trends are reflected in many other countries throughout the developing world.

But despite this growing impact, gig economy workers often face a lack of jobs and social benefits (including access to pensions and insurance) – and their vulnerability has been highlighted by the COVID-19 pandemic. CGAP reports that in Kenya, workers on gig employment platforms offering artisanal and personal services have seen their work drop off by up to 90% since business and mobility restrictions began. In response, most have had to dig into their savings (if they have any) to cover their living expenses. Those without savings are finding it hard to cope with the lockdowns.

The Challenges of Insuring Gig Workers

Gig work also does not fall within the customary contractual structures and grievance mechanisms provided by traditional formal employment. Insurance, for example, has traditionally targeted the formal sector. There are very few insurance companies that offer adequate and accessible products to gig workers. The nature of gig work makes offering insurance products to these workers much more difficult.

Gig work varies significantly based on the technical platform, type of work and risk exposure. Online gig workers are, in particular, more complicated to insure due to the on-demand and unpredictable nature of their work. Poor and irregular pay, unstructured contracts (or a lack of any contract at all), and inconsistent cash flows are some of the leading reasons why gig workers are difficult for traditional insurance companies to serve. As a result, most products provided by these insurance companies do not meet the unique needs of the gig worker segment. To address this issue, in partnership with the Mastercard Foundation, MSC has supported the development and delivery of microinsurance products to serve gig workers.

The need for these products can be seen in the example of Mutiso, a 28 year-old carpenter MSC met through our microinsurance project. Mutiso runs a furniture workshop on one of the busy roadsides in Nairobi, and he joined the Kenya-based online gig platform Lynk as a pro three years ago, hoping it would introduce him to regular customers and smooth his business’ cash flow. Lynk provides professional services by matching customers to a pool of blue-collar, largely young workers, and like most gig platforms, a large portion of its workforce lack insurance – even though their work is often physically demanding and even hazardous.

Mutiso’s job requires him to use dangerous tools to cut, shape and build furniture. He was always very careful and rarely had an accident at work. However, two years ago, as he was sawing a large trunk of wood to make a table, he moved the log too fast and cut half-way through his forearm. This injury put him out of work for six months. He had no source of income during that period, and no health insurance. It cost him over KES 200,000 (roughly US $2,000) just for the hospital bill, and he had to rely on friends and family to pay for his treatment.

Creating Microinsurance Products for Gig Workers and Platforms

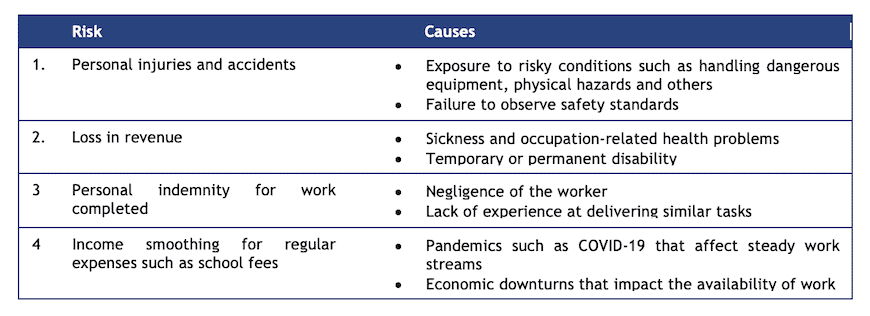

How can microinsurance providers serve workers like Mutiso, while also sustaining their businesses? To generate solutions, behavioral research and human-centered design can be applied to develop product concepts that are adequate and accessible, and that meet the needs of gig workers. Among young gig workers, some of those needs could include the following:

How can insurance providers cover those risks sustainably, while making products that appeal to gig workers? Based on our research, some key insights that can help providers develop microinsurance product concepts include:

- Responding to the flexibility of workers’ gigs: Gig workers would like to be able to afford insurance coverage before they commence their gigs. Thus, the product should have an on-demand coverage option that allows workers to pay premiums only when carrying out gigs. The premium is based on the expected number of gigs they’d complete per month/year.

- Incorporating the use of technology: Considering the tech-savvy nature of young gig workers and their need for an efficient experience, providers must digitize and embed technology at each stage of service. Thus, the core processes such as enrollment, premium payment and claim settlement should be digitized.

- Offering affordable and dynamic pricing: Differential pricing and payment models could make it easier for gig workers to afford the premiums. To reduce the cost of access to insurance, a liability sharing model could be developed, in which both the gig platform and the gig workers contribute towards the premium payment. The flexibility of gigs demands a dynamic pricing model, where the gig workers may split and pay their premiums across a predicted number of gigs.

In our research, we’ve seen some providers beginning to respond to gig workers’ needs. For instance, one insurance provider is now piloting an umbrella personal accident product for workers on the Lynk platform, which will include the following attributes:

- On-demand access: The provider has assessed the gig platform’s overall insurance needs to develop and deliver an umbrella personal accident coverage product for all the gig workers associated with the platform. The coverage is applicable during the working period, and protects gig workers against all the risks associated with their gigs. The provider is offering work injury benefits to all its gig workers exposed to personal accidents.

- Pooled and worker-agnostic coverage: The insurance product is pooled, meaning it covers a specific and pre-determined number of workers at any given point of time. The number depends on the history of active daily workers on the platform, but does not prescribe the specific individuals who’ll be insured (i.e.: it’s worker-agnostic). This approach acknowledges that among the platform’s pool of gig workers, not all of them will work on the same day or at the same time, so it is certain that not all workers will be at risk every day. For instance, if only 400 out of 1,000 workers are active on any given day, the platform pre-pays insurance for only the daily active workers. Consequently, the premium paid per worker is significantly reduced.

Through behavioral and human-centered research, providers can understand the dynamic nature of gig employment, the risks that affect these workers, and the practical use cases that they commonly encounter. With this understanding, they can design effective microinsurance product concepts for gig platforms and their workers. The COVID-19 pandemic has highlighted the reality that gig workers get the short end of the stick when it comes to financial services – particularly insurance. The technology that drives the gig economy provides important opportunities to address this challenge, and to extend the benefits enjoyed by formal economy workers to these informal workers.

Peter Karah is an analyst and Olivia Obiero and Edward Obiko are managers at MSC, a NextBillion partner.

Photo courtesy of Jan Truter.

- Categories

- Finance