From New York to Madagascar: Why I Moved My Fintech Startup to Africa

Many years ago, I read Steve Blank’s article about the need for entrepreneurs to have seamless agility while running a startup (the article was titled “There’s Always a Plan B”). He opened it with this quote from Mike Tyson: “Everyone has a plan ‘till they get punched in the mouth.”

Now that I have been working on my own startup for a few years, I think about that article, and especially that quote, a lot. Being an entrepreneur is (probably, I should say) a lot like being a boxer — you may have an initial strategy, but once you launch, you must be adaptable and respond to an endless list of external factors: customer feedback, technology constraints, user behavior, etc. This article is about my experience launching a startup and how my search for product-market fit made me consider a plan B.

Background

I started my company, Teller, because I felt that many financial institutions in the U.S. were failing low-income customers. Studies showed that many people, especially those who were lower-income, often ended up paying significant account fees, overdraft fees and interest rates. Although there were many underlying reasons, I noticed one major gap was how banks presented and communicated their products to new customers.

Teller was started as an automated banking “chatbot” that would help financial institutions better communicate with customers through messaging apps such as SMS and Facebook Messenger. My vision was to provide every person with their own virtual financial assistant that would help them understand their new accounts, avoid excessive fees, and provide helpful tips and reminders. For example, when someone opened a new checking account, Teller could send personalized messages straight to their phones – walking them through account features, configuring automatic payments and setting savings goals.

My initial launch strategy was to follow the popular Lean Startup strategy: build, ship, learn, iterate. Through some sales outreach, I found a local credit union in Brooklyn that was interested in a partnership. Over the next few months, we carefully built an SMS-powered chatbot that would answer basic account questions, and share general news and events from the credit union.

After launching, I closely monitored the platform to see how customers would respond. Unfortunately, things weren’t going as we’d hoped: We had little repeat engagement, our response accuracy was lower than expected and we were frustrating customers who thought that there was a human on the other side of the bot. Over the following few months, we made several improvements and managed to address some of the issues. But despite some iterative progress, I realized that I needed to go back to the drawing board. At the time, it felt like this was the startup equivalent of getting “punched in the mouth.”

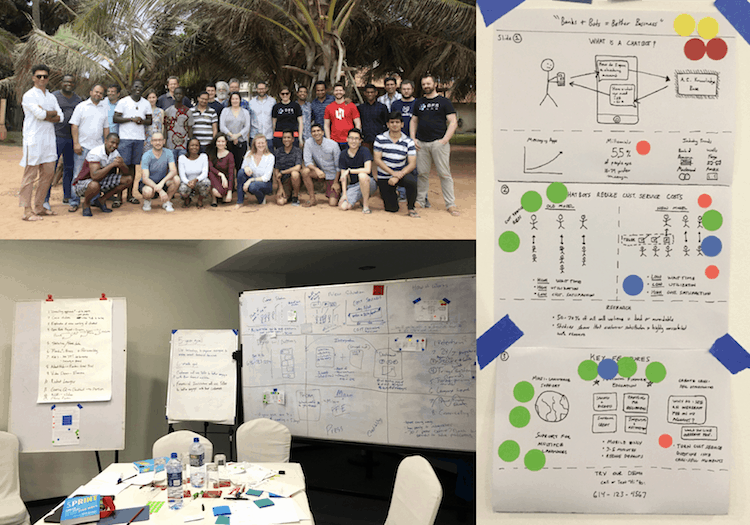

Around this time, I came across a one-week boot camp for financial-inclusion startups called DFS Lab. Startups that were accepted into the program would spend an intensive week conducting a “Design Sprint” to get immediate feedback from potential users. It was my first chance to question some of the assumptions I made and collect unbiased feedback from customers, mentors and industry experts. My major learnings all focused on better understanding the opportunity for Teller in developing markets: (1) replacing existing (or sometimes nonexistent) customer service channels, (2) expanding my target customers to include mobile-money providers, and (3) capitalizing on low smartphone penetration through SMS and USSD.

Coming out of the boot camp, I made some immediate changes.

“Design sprint” in action with my DFS Lab cohort

Choosing a New Market

In the summer of 2017, I shifted my main focus from the U.S. to developing markets, and specifically sub-Saharan Africa. This market had two specific characteristics that made it perfect for a messaging-based chatbot: (1) Users were mobile-first oriented and were already accustomed to accessing financial services through their phones, and (2) existing customer service and education channels were either nonexistent, time-consuming or intimidating.

Product Changes

Aside from changing markets, I also made four discrete product changes:

- Identifying the killer use-cases — reasons for people to use the bot and keep coming back

- Enabling the in-house customer support team to jump into a conversation when our bot struggles

- Supporting multiple messaging channels (SMS, FB Messenger, web app, etc.)

- Conducting extensive pre-launch testing with internal staff, and if possible, focus groups

All of a sudden, these changes started to pay off. Teller received a grant from the Gates Foundation to help us expand to developing markets and accelerate growth. A few months later, one of the mentors of the boot camp, who was the head of digital products for Orange Money Madagascar, reached out to me to explore how we could build a mobile-money assistant using SMS. We decided to start working together on a pilot.

The next six months were dedicated to development, and solving difficult technology challenges like building our own SMS gateway, connecting our chatbot to a USSD code, and training our bot to respond to hundreds of questions accurately in French (along with basic support for Malagasy). For its part, Orange Money was a very dedicated partner and leveraged its marketing team to conduct focus groups and develop a friendly personality for our mobile money assistant, “MoMo.”

We soft-launched MoMo on SMS in January, and added support for Facebook Messenger in February. Although I can’t share detailed metrics about the pilot, I can say that MoMo has exceeded our expectations and has shown very strong early traction. Taking a measured approach has given us a chance to make thoughtful decisions that focus on building trust with the customer over time.

This pilot, along with new engagements from other financial institutions, has provided good confirmation that general market trends are in our favor. Messaging apps will soon reach 2.5 billion users, and supporting these new channels is going to be crucial for financial institutions. Teller is well-positioned to help these organizations onboard and educate customers, while cutting existing customer service costs – something particularly important for lower-income users and the financial institutions trying to serve them. (Shameless plug: If you’re interested in learning more, please reach out for a product brochure).

Closing Thoughts

To borrow a mantra from my previous employer, Teller is only 1 percent done. Although I have huge plans for Teller, I feel much more confident in my seamless agility and the path that Teller is on. And if that doesn’t work, I’ll be ready with a strong plan B (or C, D, E…).

Sidharth Garg is the founder and CEO of Teller. He also worked at Facebook, where he helped launch payment products like P2P Payments and Facebook Gifts.

Photos courtesy of Sidharth Garg.

- Categories

- Finance, Social Enterprise