NexThought Monday: Our inaugural podcast – a conversation with the MasterCard Foundation’s Ann Miles

In April, the MasterCard Foundation Fund for Rural Prosperity awarded over $10 million to five innovative companies working to increase financial access in rural Africa, through its now-annual Scaling Competition. The winners included both lesser-known firms and companies that are household names to anyone who’s followed mobile finance’s stunning growth on the continent. They included:

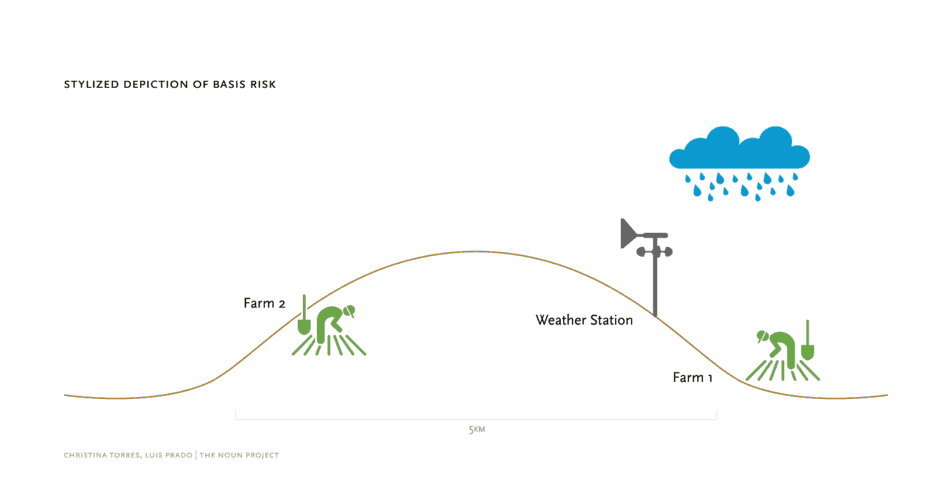

- APA Insurance Ltd., which will offer weather insurance for smallholder farmers, using satellites to help determine when a claim event is triggered without the need for physical inspection.

- Finserve Africa Ltd./Equitel, Equity Bank’s telco-banking convergence platform, which enables rural dwellers and smallholders to perform financial transactions, make calls, send SMS messages and browse the internet – and which hopes to scale from its 10 million current customers to 100 million in 15 Sub-Saharan African countries by 2024.

- M-KOPA LLC, which utilizes mobile connectivity and smart data to open a line of credit for underserved customers, and hopes to help more than 300,000 customers in rural Tanzania improve their liquidity and allow investment in assets that increase their productivity, profitability and resilience.

- Musoni Kenya Ltd., which plans to scale its mobile-based loan product to help smallholders diversify their enterprises, expand existing farms and venture into new farming activities.

- Olam Uganda Ltd., one of the world’s leading agribusinesses, which will offer interest-free loans and extension services to smallholders who sell Olam their crops as part of its coffee procurement supply chain. It aims to scale up these services in Uganda from the current 8,000 to 20,000 households, improving farmers’ yields while optimizing its own operations.

Ann Miles

According to Ann Miles, Director of Financial Inclusion & Youth Livelihoods at the MasterCard Foundation, the foundation selected companies with some key characteristics in common: “What’s most important to us is to learn from models and approaches that have worked. … Even though this engages private sector companies, this has to be more than a business proposition.”

In NextBillion’s inaugural podcast, we spoke to Miles about the competition’s winners and the broader digital financial inclusion space in Africa. We hope to add this podcast to both Apple and Android device platforms – it is currently available on the NextBillion page on SoundCloud, where you can follow us to learn about future podcasts. You can listen to the interview in its entirety at the top of this post – or hear specific answers by skipping to the time codes listed after each question below:

- Setting the stage, can you explain why the MasterCard Foundation is focused on advancing rural prosperity in Africa? How big is the need, and what are the potential impacts of greater financial inclusion in these areas? Why focus on agriculture, and why in Africa? (Answer at 1:14)

- How long has the competition been going on, and what kinds of results have you seen so far? Relatedly, how does the foundation measure the social impact of the support it offers these companies? (Answer at 4:00)

- Could you briefly list the five 2015 winners, what they offer and how their imaginative approaches earned your support? (Answer at 6:10)

- Credit and insurance seem pretty well represented among this year’s winners, with two winners focused on providing each of these products. Is this deliberate on the foundation’s part – that is, are credit and insurance the products you feel have the best potential to serve the most essential customer needs at scale? Is scaling up a savings product a more challenging proposition? (Answer at 14:45)

- Are there any significant risks to increasing access to credit among smallholders, and if so, does the MasterCard Foundation work to help companies minimize them? (Answer at 16:50)

- Three of the five winners are focused primarily on Kenya – is there a risk of Kenya “hogging the spotlight” in mobile financial inclusion, at the expense of other countries who arguably could use more support? If so, might this be a consideration in selecting future winners? (Answer at 18:28)

- The fifth winner, Equitel, had faced stiff resistance from market leader Safaricom, in the form of multiple legal and regulatory challenges aimed at preventing or delaying its entry into the Kenyan market. Should the foundation’s efforts to help Equitel scale up be seen as an endorsement of the need for more competition in markets like Kenya, where one player is dominant? (Answer at 21:21)

- What advice would you give to businesses that are interested in applying for the 2016 award? Briefly, what qualities could make an applicant stand out from the pack? (Answer at 22:34)

- Zooming out a bit, what excites you the most about the development of mobile finance in Africa – how big an impact do you see it making over the next 10 years, in the best case scenario? (Answer at 24:44)

- Conversely, what do you see as the worst case scenario – is there anything that could potentially derail the growth of mobile finance, or seriously limit its ability to positively impact low-income communities? (Answer at 26:34)

- Is there an element of benevolent self-interest to the MasterCard Foundation’s efforts to boost financial access among the poor, assuming that MasterCard’s services might be among those available to these emerging customers? (Answer at 29:42)

Photo credits: Cecilia Schubert, via Flickr.

James Militzer is the editor of NextBillion Financial Innovation.

- Categories

- Agriculture, Technology