Making it Rain: The forecast on weather index insurance

Is there any profession where risk is more profound than that of a smallholder farmer? (Perhaps derivatives traders, but I’m less concerned about their welfare.)

Millions of farmers in sub-Saharan Africa and South Asia subsist on small, rain-fed plots. Increasing productivity and profitability of these farmers is an important avenue for reducing poverty. Adoption of new farming techniques and inputs like fertilizer, in addition to expanding land under cultivation, could increase yields and help rural families move out of poverty. Hanging over the heads of these farmers (quite literally) is the risk that the rains won’t come, will come too late, or come far too much. Plus, adopting new practices and inputs is risky – farmers don’t know how these techniques and inputs will perform. To play it safe, farmers choose not to use potentially profitable inputs, instead opting for lower-yield, but more reliable crops and practices. Risk and ambiguity aversion keeps farmers from adopting inputs and practices with which they aren’t familiar.

My colleagues and I at the Agricultural Technology Adoption Initiative (ATAI) recently completed a bulletin reviewing 10 randomized evaluations of weather index insurance called Make It Rain. ATAI is a research collaboration between the Center for Effective Global Action (CEGA) at UC Berkeley and the Abdul Latif Jameel Poverty Action Lab (J-PAL) at MIT, which has funded over 40 randomized evaluations in sub-Saharan Africa and South Asia focusing on strategies to increase technology adoption by the poorest farmers.

While weather risk is a major barrier, traditional crop-loss insurance is rarely available to smallholder farmers in the developing world. High monitoring costs for insurers keep them from offering these products. However, weather index insurance is intended to protect poor farmers while reducing insurers’ costs. By basing payouts upon a freely observable outcome like rainfall, weather index insurance products should protect farmers without the high costs of measuring individual losses. Two other common concerns with insurance also are reduced: adverse selection and moral hazard.

Adverse selection occurs when people who take more risks decide to insure more often than those who are less risky. This increases the likelihood of higher payouts and grows costs for insurers. With weather index insurance, farmers’ behavior has no effect on the likelihood of payout. Insurers need not worry about adverse selection.

Moral hazard – the tendency to engage in riskier behavior once insured – is especially interesting and important in the context of weather index insurance, but not in a way that normally concerns us. It’s unlikely that any farmer behavior will affect the weather directly. (Is there an RCT on rain-dances anywhere?) However, protection against losses due to weather may induce farmers to overcome ambiguity aversion and be willing to adopt new inputs despite uncertainty about their affect. When the weather is bad, farmers may have worse outcomes than without insurance, but when weather is good, farmers will likely have better outcomes. With insurance, farmers who adopt new technologies should benefit regardless of the rains; they are protected when the weather is bad, but do much better when the weather is good.

Here’s the good news about weather index insurance. When farmers use it, they make riskier, but potentially profitable decisions, by planting higher-value cash crops and using more fertilizer. Studies in India, China, Mali and Ghana find that insured farmers grow more cash crops and higher-yielding crops, decisions which could lead to greater yields and more profits for these farmers. In Ghana, researchers randomly assigned farmers to receive free insurance, a cash grant, or both. Insured farmers increased what they spent on farming, used more fertilizer and cultivated more land. Farmers who just received cash bought more fertilizer, but the effects were smaller than those on insured farmers, suggesting that risk presents more of a constraint to farmers than credit. (If you are interested in this study, check out the short video below, Digging for Answers, which discusses the study in more detail and introduces the researchers’ current work in the area.)

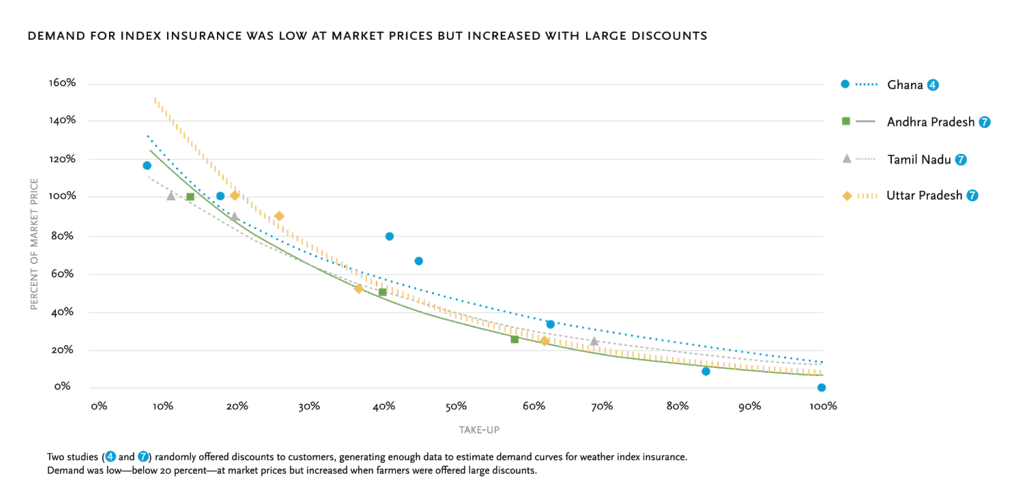

Now for the bad news. While insurance has the power to lead farmers to make potentially profitable investments in their farms, few farmers take up insurance when it’s available. Studies in Ethiopia, Ghana and India that offered insurance with no discounts found only 6 percent to 18 percent of farmers bought the products. Farmers also only covered small portions of their land. At this level of take-up, insurers would not be able to operate profitably.

Researchers experimented with many ways to increase adoption of insurance at market prices. In India, farmers who received financial literacy training were more likely to purchase insurance, but the cost of the training per farmer was several times the price of insurance. Perhaps linking credit with insurance could persuade farmers to buy it. However, farmers seemed to be less likely to purchase insurance when it was combined with credit. In Malawi, when insurance was offered as part of a loan, farmers took out the combined product at half the rate of those who were offered the credit alone. Perhaps farmers don’t trust that they’ll receive a payout when the weather is bad. Insurance offered through trusted local organizations had inconclusive results, increasing adoption in one instance and having no effect in another.

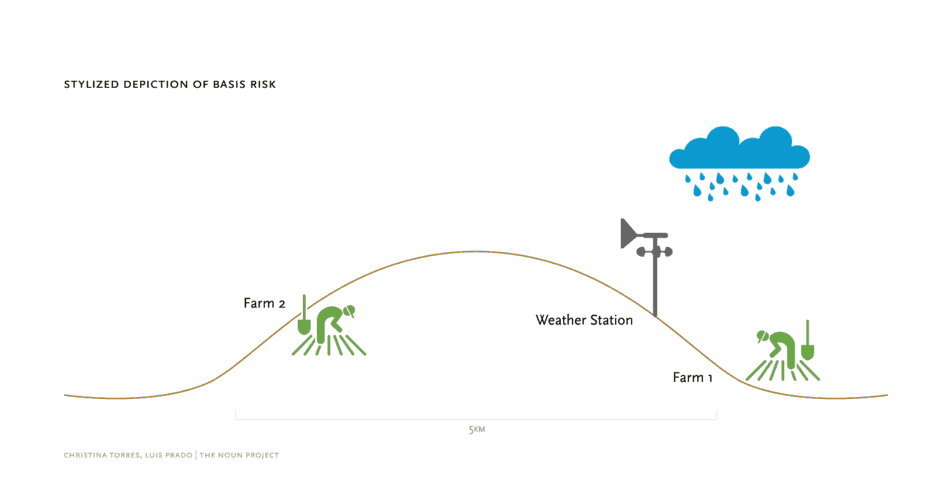

Beyond trust in the insurer, farmers have a structural reason not to have confidence in weather index insurance: basis risk. Payouts to farmers are based not on rainfall on their land, but on rainfall at weather stations. It’s likely that these measurements will differ. A farmer could not get enough rain, but the weather station readings might say that rain was sufficient. Farmers may have crop failure due to weather, but receive no payout. Group risk sharing might protect against basis risk. When researchers offer insurance with training on group risk sharing or in communities where this already occurs, more people buy weather index insurance.

The one thing that dramatically increased adoption of weather index insurance was very steep discounts. Unsurprisingly, as greater and greater discounts were offered, many more farmers used insurance.

Where does this leave us? Protecting farmers against risk can help them to make investments and supports them in bad weather. Continuing to develop strategies to protect farmers’ risk should remain a priority. One idea is to improve index quality, for example through remote sensors, which would reduce basis risk. Some researchers have already started working on this. Another idea is to think of weather index insurance as a substitute for cash transfers. As free insurance induces increased investment, but only requires payouts in bad years, insurance may be more cost effective than cash transfers. Another suggestion posits that perhaps farmers are the wrong target. If agricultural lenders or governments were insured against weather risks, they may be able to provide capital to farmers. Lastly, maybe we shouldn’t be focusing on a financial product, but be promoting stress-tolerant crops that protect against drought or flood in their own biology. (Check out our publication on flood-tolerant rice, Resilient Rice.)

Top image: A researcher speaks to a farmer in northern Ghana. Image by Mohammed Ibrahim, courtesy of J-PAL.

Ben Jaques-Leslie is a Senior Research and Training Manager at Abdul Latif Jameel Poverty Action Lab (J-PAL) at MIT.

- Categories

- Agriculture