The ‘Start Small, Stay Small’ Dilemma: How Nonprofit/Private Partnerships Can Boost Women-Owned Businesses

Between 2007 and 2016, women started businesses five times faster than the national average. From our experience working with female entrepreneurs across the U.S., we know that they have the grit and determination it takes to create and grow thriving businesses. And, the wealth generated by those businesses has the potential to benefit not only their owners but also their families and communities for generations to come. The median net worth of business owners is almost two and a half times greater than that of non-business owners — and for an African-American woman, the difference is more than 10 times. Women also reinvest substantially more of their business profits back into their families and communities compared with men.

Challenges Facing Female Entrepreneurs

Despite their potential, too many female entrepreneurs struggle to access the capital and resources they need. In 2017, women-owned businesses received 14 percent of the Small Business Association’s smaller 7(a) loan dollars and 11 percent of the larger 504 loan dollars, which require traditional collateral to access. Of all of the venture capital deployed in the U.S., only 8 percent goes to women and 1 percent to African-American women.

Women-owned firms tend to start small and stay small, in part due to challenges accessing credit, and they are more likely to be discouraged from applying for financing due to fear of being declined. More than two-thirds of women-owned businesses are looking for less than $100,000 in financing, while traditional lenders tend to offer much larger loans (the average business loan provided by a bank was $663,000 as of August 2017). Additionally, female business owners are more likely to have poor credit than male business owners, constraining their access to traditional finance options. New, alternative lenders help to fill the gap, but some of their products are costlier than they seem—leaving women surprised by lack of transparency and high interest rates.

Filling a Market Gap

Mission-based lenders like Accion in the U.S. and Grameen America, the organizations we represent, fill a market gap for affordable, transparently priced capital among female entrepreneurs. We provide the small-dollar loans that enable their businesses to start and grow, and we are able to look beyond credit history to say yes to entrepreneurs who wouldn’t qualify for a traditional loan. Equally important, the financing and support our organizations provide help entrepreneurs build confidence in their ability to improve their credit and grow their businesses. Our data reveal that women tend to have lower income and lower credit scores than men, but if you give them a loan they also have better repayment history. These are precisely the types of entrepreneurs who would be overlooked by traditional lenders, but whose commitment to providing a better future for themselves and their families makes their businesses great investments.

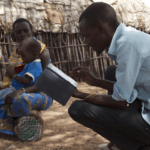

Take Mariel, who found herself living in a homeless shelter with her three children after escaping an abusive relationship. She had the skills to start a flower business, but as an immigrant, she had limited credit history. “Accion was that key that opened the door for me to start my life again. I was able to get on my feet, to stop being homeless and living in shelters. And now I have my house,” she said. As an entrepreneur and survivor, Mariel is an inspiration to other women in her community who are overcoming major life challenges. Most importantly, she serves as a role model for her children. “It’s so inspiring, for someone to come from basically nothing and have her own business and be able to teach other women that were in her same situation,” said Mariel’s daughter, Lexi.

When Magdalena first came to the United States from Mexico, she was making $1.25 an hour cutting thread at a factory in New York. While she eventually learned how to use a sewing machine and began earning $2 an hour, she was still struggling to afford the basics like rent and food. For added income, she began working at a restaurant and started her own business selling makeup and other products. Then she heard about Grameen America, and with the help of microloans, her economic prospects began to improve. Magdalena now has her own bar and restaurant in the Bronx. She has built up her savings, and her dream is to expand her business and open a chain of restaurants. “Grameen America has been a light of hope,” she said. “It gave me the opportunity to succeed, to demonstrate to myself how far I can go.”

Importance of Nonprofit-Private Partnerships

Unfortunately, our industry continues to fall short in addressing the immense need for capital among female entrepreneurs. In 2016, nearly half of women-owned businesses experienced challenges in accessing sufficient credit. Our organizations are faced with a pressing imperative to expand our services while continuing to offer the personalized support that enables small businesses to thrive.

It will be impossible to reach the scale that is needed to meet this demand without partnerships with the private sector. For example, our relationship with Mastercard Center for Inclusive Growth is helping our organizations secure the technology and talent we need to digitize our operations, reach more business owners, and serve them better. Equally important, our organizations have the opportunity to benefit from the additional skills, insights, and thought leadership of our partners to accelerate our impact. Finding a partner that shares our vision for a more equitable future means that we can get there faster, together.

Gina Harman is the CEO of Accion’s U.S. Network.

Andrea Jung is the president and CEO of Grameen America.

Top image: Mariel Cota at her business, Flowers by Mariel, in San Diego. Image credit Accion

- Categories

- Uncategorized