Understanding the Coping Strategies of Financially Distressed Households: New Data Shows Their Value — And Lasting Consequences

As we discussed in an article last fall, according to FINCA survey data, which covers 11,000 households in 13 countries, almost 80% of our clients experienced deteriorating food security as a result of lost income between 2020 and 2021. This is just one sign of the impact COVID lockdowns had on low-income communities around the world — and it offers a glimpse into the coping strategies these vulnerable households must employ to respond to financial shocks.

Further financial shocks are a virtual certainty for these households, and our data also reveals the resilience strategies our clients are likely to employ to navigate them. We also assessed these clients’ underlying risk factors, to see which of them have the highest potential to rebuild their savings, since strengthening savings habits and rebuilding their assets are key to their future resilience.

Using the data set mentioned above, our model shows how these families sustained their daily consumption through savings, credit and selling off assets. Using supervised machine-learning classification algorithms, we were able to create profiles that were associated with each type of coping strategy. To varying degrees, these coping strategies left families in an economically weakened state — and therefore more vulnerable to future economic disruptions, whether at the household or a more generalized level.

Using Savings to Purchase Daily Necessities

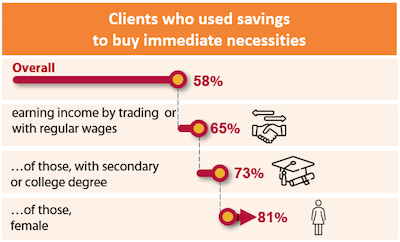

The most common coping strategy — and presumably the least painful one — was using savings to buy necessities, which was reported by 58% of clients.

Studies show that people who save are better able to pay their bills on time, feed and support their families, and even earn more over the long term.

Our analysis shows that people who used their savings to supplement lost income were mainly business owners and regular salary earners.

Interestingly, four out of five people with enough savings to absorb financial shocks were women with higher education, who tend to have better saving habits.

Borrowing for Consumption

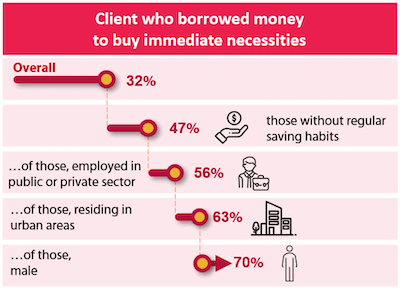

In response to lost income, a third of FINCA clients borrowed money for daily consumption. But this short-term strategy comes at the cost of more debt and interest. Consumption loans were more prevalent among people who lacked strong savings habits. They were also more common for people with stable jobs and access to credit (56%), especially wage-earning men in urban areas (70%).

In response to lost income, a third of FINCA clients borrowed money for daily consumption. But this short-term strategy comes at the cost of more debt and interest. Consumption loans were more prevalent among people who lacked strong savings habits. They were also more common for people with stable jobs and access to credit (56%), especially wage-earning men in urban areas (70%).

The Global Findex 2021 survey paints a very similar picture; only about half of adults in developing economies were confident they could mobilize resources within a month if faced with an unexpected need.

Families who cover their daily expenses with consumption loans are putting their future at risk, as credit is becoming more expensive due to rising interest rates. Often, these households struggle to put enough food on the table, so they will clearly have trouble paying their debts.

Selling off Property

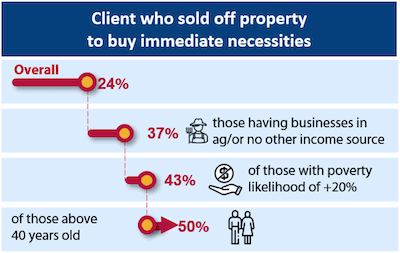

Selling off assets was the last and likely the most painful coping strategy. It was employed by 24% of FINCA clients, especially those who work in agriculture and have no other income. This is the only coping strategy that was explicitly associated with poverty, used by 43% of those who were poor and dependent on agricultural incomes.

Selling off assets was the last and likely the most painful coping strategy. It was employed by 24% of FINCA clients, especially those who work in agriculture and have no other income. This is the only coping strategy that was explicitly associated with poverty, used by 43% of those who were poor and dependent on agricultural incomes.

There was also an age dimension to this strategy, which was more prominent among those over 40 years of age. Due to its relative infrequency, and limitations in our data, this model maxes-out at 50% probability, while the others reach 70% and 80%.

One of the main disadvantages of this strategy is that people facing hard times will most likely agree to accept a lower price for their hard-earned assets, and will pay more to replace them later. A family that has effectively consumed their capital during a crisis isn’t only poorer and less resilient — their future is more precarious as well.

A Stronger Willingness to Save

The continued slump predicted for the global economy will further damage the financial health of many vulnerable families, especially those whose savings and assets are depleted, or who have incurred new consumer debts. But negative experiences can have a powerful, and sometimes positive, effect on future behavior.

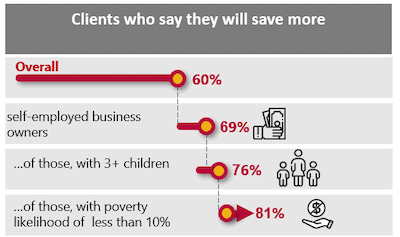

Following the shocks they’ve experienced, more than half of our clients hope to save more money in the future. Self-employed people, whose earnings are more volatile, are especially motivated to save as a buffer against income shocks.

Children are also a driving factor — among the self-employed, 76% of those with three or more children express a stronger intention to save. Finally, the intention to save is enhanced by the ability to save. Plans to save more are more common among people with less than 10% probability of poverty.

While it is encouraging that 60% of respondents are more motivated to save than before, financial institutions have to play their part to help rebuild savings habits, especially among those who are currently underserved. The Global Findex 2021 survey reports that account ownership around the world increased by 50% during the past 10 years, from 51% to 76%. But about two-thirds of unbanked adults said they could not use their newly opened accounts without help, a percentage that will likely increase as financial services become more digitized.

Making Saving Affordable and Desirable

Low-income households are the most likely to under-save, in part due to information and knowledge gaps. The Findex data confirms that especially now, when financial services are predominantly digital, financially inexperienced users may not be able to benefit from account ownership if they do not understand how to secure its benefits and avoid consumer protection risks.

FINCA’s research team is currently exploring ways to make savings products easier to access, use and afford. We have recently published a study showing that remote coaching through phone and text messages was effective at stimulating more active account usage, including the use of banking agents, which increased by as much as 264%. Coaching also increased the number of transactions by as much as 250% among those who participated in at least eight phone-based coaching sessions.

Future economic shocks — driven by climate change, among other factors — will have a disproportionate impact on low-income households. Strengthening their savings habits, rebuilding their emergency funds and helping them utilize digital financial solutions now will help to prepare them for the challenges ahead.

Download the data summary report here.

Scott Graham is Vice President for Research and Data Science, Anahit Tevosyan is Director of Research, and Andrée Simon is president and CEO of FINCA Impact Finance at FINCA International.

Photo credit: Evandro Sudré

- Categories

- Finance