Finding the Right Last-Mile Distribution Model

The challenges of bringing market-driven solutions to base-of-the-pyramid (BoP) customers are widely documented. Fragmented markets, poor infrastructure, hard-to-reach customers and rudimentary banking and credit networks are a few among the many factors that make it challenging to reach scale and profitability. Nevertheless, a surge of actors – corporations, NGOs, government agencies and social ventures – are committed to reaching these frontier markets. They are learning what works and what doesn’t, but these experiments are often pursued in isolation, and a lot of their innovative approaches and lessons learned are not well documented and shared.

To address this knowledge gap, MIT D-Lab created the Practical Impact Alliance (PIA), which brings together leaders from diverse organizations working in inclusive business. PIA fosters opportunities for structured engagement, practical cross-learning along areas of common interest and exploration of collaborative action.

In 2015, PIA members formed a working group that identified last-mile distribution as an area of focus, concentrating on two key questions: 1) What is the best way to select a distribution network model?; 2) What is the best way to set up a door-to door distribution channel?

The working group included fast-moving consumer goods companies Ajinomoto, Danone, Johnson & Johnson, Mars and SC Johnson; international nongovernmental organizations World Vision and Grameen Foundation; and social ventures Greenlight Planet, Community Enterprise Solutions and Living Goods. The working group shared 14 case studies and generated written outputs to serve as practical guides for PIA members and a broader audience of practitioners who are interested in forging viable and scalable distribution networks.

The final output of the group was a 43-page guide called Best Practices for BoP Door-to-Door Distribution.

Which distribution model is right for you?

The working group analyzed three distinct models for last-mile distribution:

- Last-mile retail: Products from one or multiple companies and brands are displayed and sold in fixed retail locations (e.g. mom-and-pop shops, third-party retail chains or proprietary retail shops).

- Institutional partnerships: Piggybacking on a partner organization’s assets, capabilities and relationships in the target market to bring the product to, or closer to, the customer.

- Door-to-door (D2D): A network of door-to-door agents carries and sells products from one or multiple companies and brands, addressing a range of related and unrelated needs.

To help inclusive business practitioners navigate which one is a better fit, D-Lab built on the collective knowledge of the group to develop a dynamic decision tool called the D-Lab BoP Distribution Compass. The compass guides users toward the most appropriate distribution model by enabling a nuanced assessment of product characteristics, market conditions, as well as organizational capabilities and priorities. The tool, comprised of 23 questions, can be used by companies looking to enter a new market or re-evaluate their existing distribution strategy for a physical product at the “last mile” of the supply chain. The tool is also designed to match the user responses with the most relevant case studies based on their product category as well as their sectorial and geographic focus. D-Lab is presently exploring the development of this tool into a web-based open resource.

Best practices in door-to-door distribution

When the product has a complex value proposition, is new to the market and the demand for it is low, the company often needs to employ the high-touch and the high-push approach that is characteristic of the door-to-door distribution model. Although the benefits of building a parallel sales channel to reach hard-to-access customers are compelling and can provide a strong competitive advantage, the D2D distribution model is a high-investment and high-control strategy. Establishing an agent network can take a long time and significant resources, often delaying financial sustainability for several years.

Although there is no one-size-fits-all model to set up high-performing distribution networks, the group identified a number of best practices that apply equally to any type of D2D distribution network. Whether you chose a proprietary or a shared model, a franchise, salary, commission or hybrid compensation scheme, the best practice guide developed by our working group is a road map for setting up appropriate processes and management practices for the agent network to function and scale effectively.

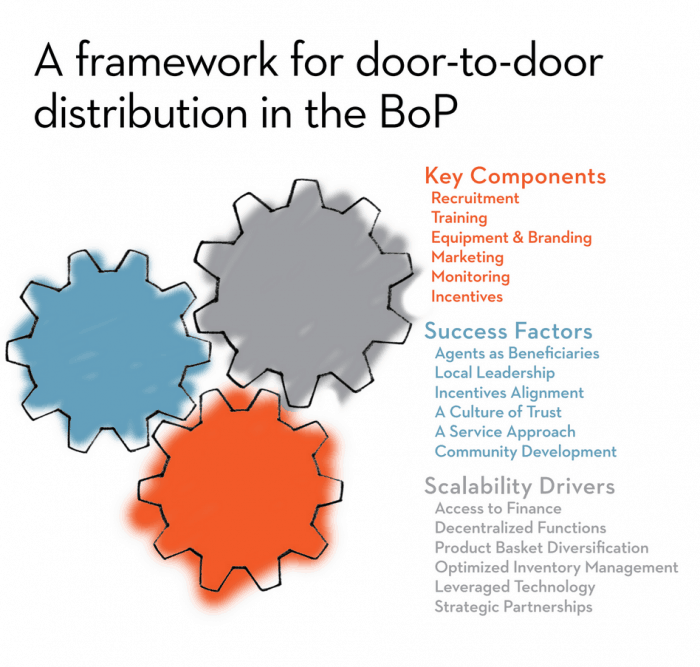

Starting with the right building blocks

The network of distribution agents is the foundation of a D2D distribution model. Competent, agile and motivated agents are the key to accessing difficult markets and lowering customer acquisition costs. However, identifying, training and retaining an effective agent network in BoP markets require careful planning and oversight as well as a significant investment of time and resources. Here is a sample of good practices presented in our guide that have proven to be effective in fostering successful and scalable networks:

In Guatemala, Community Enterprise Solutions created Soluciones Comunitarias (SolCom) as a local social enterprise that aims to achieve financial and administrative self-sustainability for the micro-consignment model at the local level. SolCom is owned and managed by the rural agents who have “risen through the ranks” as leaders in the MicroConsignment enterprises. Community Enterprise Solutions uses its micro-consignment model to lift the financial risk off rural agents who can least afford it by providing them with the products at no cost. Once the product is sold, the agent pays back the organization, earns a portion of the profit, and restocks in order. This allows agents to test the market and share the risk, thus aligning the interests and gains for both parties.

- Recruit individuals who display a unique and relevant mix of talents, assets and motivations to successfully carry out distribution tasks and drive the desired social impact in their communities;

- Approach training as a holistic opportunity to engage and empower agents;

- Leverage sales equipment and company branding to enhance agents’ day-to-day effectiveness;

- Invest in marketing to increase product awareness, augment demand and allow agents to focus on sales;

- Employ comprehensive monitoring practices to reveal sales trends, identify underperforming agents and markets to inform in-time adjustment of distribution strategies;

- Introduce incentives that align with agent preferences, values and priorities to keep them motivated and lower attrition.

New outlook, new management principles

As challenging as it is to reach rural consumers, access does not equate with success. More than ever, in contexts where markets and communities are often indistinguishable from each other, where transactions are mostly informal, and where people rely on social networks for making purchasing decisions, companies need to deploy transformational engagement strategies to gain a foothold. Across multiple case studies, we found that what sets certain companies apart is the ability to build value-based relationships with agents, channel partners and local stakeholders.

Here is a set of recommendations extracted from our guide for establishing D2D channels:

- Consider distribution agents as employees and program beneficiaries;

- Foster leadership, buy-in and ownership of the distribution channel at the local level

- Align incentives across the value chain;

- Encourage agents to develop a service approach as they interact with the community;

- Create a culture of trust;

- Take an active role in community development and build capacity across all stakeholders.

An eye on scale

In an effort to increase market penetration in northern Brazil and allay the social and gender inequalities hindering the region’s development, Danone established an innovative door-to-door proximity sales channel in the city of Salvador. The company empowers women entrepreneurs (Kiteiras) to become financially independent by selling product bundles in their underserved communities.

Even after pilots succeed, the D2D sales model often fails the test of long-term sustainability and growth. Over and over, at large scale, bringing down costs and maximizing efficiency is vital to financial sustainability and companies find themselves unprepared for the challenge. For a D2D distribution channel to be profitable at scale, companies need to integrate and invest in efficient growth strategies from the start.

The most successful companies at scaling D2D networks are using a multi-pronged approach which we identified as the six key enablers of scale and they include:

- Accessible and affordable working capital to meet the needs of agents as they grow their sales, increase their inventory and expand their operations.

- A diversified product basket to balance desired social impact, volume and profit margins;

- Optimized inventory management;

- Decentralizing management and operational functions such as recruitment, training and monitoring;

- Technology use;

- Strategic partnerships with organizations that have aligned impact visions and complementary assets.

Creating a new distribution network has enormous potential. But to establish this high-touch channel, first movers have to grapple with a greater degree of management complexity, high investment costs and longer payoff timeline. Pioneering companies take a multi-pronged approach and they also practice patience, persistence and focus. Getting the building blocks right can forge the path to a viable businesses – and, most important, it can help companies with a social mission get livelihood-improving products to those that will benefit from them most. We would like to invite you to use our tools, and if possible, provide us with feedback.

Editor’s Note: This article was voted by readers as one of NextBillion’s Most Influential Articles of 2016.

Jona Repishti is the global network manager for the International Development Innovation Network (IDIN) based at MIT D-Lab.

- Categories

- Education