Rethinking the ‘Africa Play’: Why We Held Back from the Africa Investment Frenzy

Editor’s Note: For an entrepreneur’s perspective on this issue, check out this response article from Zoona co-founder Mike Quinn. For a different take from an impact investor, see this response from Marsha Wulff, Managing Partner of LoftyInc Capital Management.

In [northern hemisphere] spring 2019, the investment committee at Blue Haven Initiative’s Ventures team raised a painful question: Did we miss the boat? Running an in-house venture fund, my team had made only one new investment in 2018 (Shortlist). We’d held back for several reasons: Valuations were too high, great teams were too few and realistic unit economics did not seem to be a concern for most entrepreneurs.

At the same time, the venture market in Africa was exploding: $1.2 billion went to startups in 2018, nearly 4 times more than in 2017, and Western investors spoke of needing “an Africa play” (a real thing we heard from California-based investors). By early 2019, international limited partners (LPs) had committed an additional $1.7 billion to the continent. This capital glut brought with it Silicon Valley-style valuations. Seed and Series A rounds outstripped any sensible multiple or cash flow-based valuation, particularly in fintech, logistics and anything YC.

Along with the valuations came the Silicon Valley-style growth-at-all-costs method of scaling – let’s call it GAAC-scaling – requiring huge sums to fuel hockey stick growth, regardless of profitability. Later stage rounds began reinforcing this spend and grow mentality. Andela raised $100 million from London/San Francisco-based Generation; Branch tucked away $170 million from Silicon Valley; Kobo360 secured $20 million from Goldman Sachs in London – the list goes on. Eye-watering exits also got some stage time. For instance Jumia (JMIA), “the Amazon of Africa,” went public on the New York Stock Exchange and saw a 150% uptick in its IPO price. Simultaneously, despite billions in losses and S-1 warnings that unit economics might never materialize, Uber, Slack and Lyft debuted publicly, showering early investors with triple digit cash-on-cash returns. Seed investors that put up with overly optimistic valuations were anointed paper geniuses.

I, on the other hand, questioned my life choices.

Why Investing in Africa is Different from Silicon Valley

We have long held the thesis that tech-driven businesses in Africa are built differently than the app-based disruption that characterizes Silicon Valley. After investing in Africa for more than seven years, I’d learned that human touch was a key component of most business models. Significant, non-technical components and ground game competency are required. Integrating that reality into positive unit economics is a critical step to long-term value – maybe not right away, but eventually. Human touch is required on the customer-side as well. One of the core pillars to GAAC-scaling is unbridled spending to acquire customers – and central to this calculus is the concept of total customer lifetime value. Ideally, the average customer more than returns the high upfront acquisition costs required to bring them onboard. Once a user’s credit card is input into Netflix, for instance, revenue is charged reliably each month if the company’s product (which has low marginal cost) is delivered.

This model doesn’t translate easily to regions like Africa. Emerging market customers have access to innovative remote payment methods like mobile money, but ongoing human engagement is required to keep them active – e.g. placing a new order for fresh fruit and vegetables with Twiga, deciding to make a debt payment via M-KOPA, ordering a truck through Lori Systems, etc. Happy customers are sticky, but repeat business is not automated. Coupled with significant real-world expenses like salespeople, delivery and customer service, margins can fade away. GAAC-scaling in this environment, which also lacks reliable growth equity funding tolerant of loss-making businesses, is an unsustainable concept.

Our early bets in disruptive industries continue to be an education in navigating these pitfalls. In the pay-as-you-go (PAYG) solar space, mobile money enabled the democratization of access to and asset finance of renewable energy, on a continent with 600 million people in the dark. Private business seemed like it could fill a huge gap for marginalized populations. Foreign growth investors saw promising customer and macro trends, committing a significant portion of the nearly $1.2 billion in off-grid solar investment in 2016-2018. It seemed like we’d cracked the growth funding code.

But then came the reckoning. Economies slowed and sales wobbled, while mediocre or negative contribution margins, previously ignored, ate cash like Pac-Man. GAAC-scaling had crept in – many of these companies had paid little attention to true unit economics, buying customers and revenue upfront with the expectation that the best customers would buy and finance many other goods in the future. This land grab worked for Amazon in the developed world, but in a place that lacks basic infrastructure like addresses and extensive networks of travel-ready highways, the thesis falls apart. Along with these challenges, each market is relatively small – you’d have to cobble them together to make a market that comes close to the buying power in more developed countries. Combined with the still-young middle-class, significant trade barriers, currency risk, political instability, opaque tax regimes and heavy government debt burdens in many African countries, the outlook becomes even more daunting for startups at the micro level. With these obstacles exacerbating slowing sales, businesses in the space were forced to slash costs or consolidate. Some were snapped up by strategic investors at bargain basement prices, and some failed. Lenders were left holding the bag, and equity investors, frustrated with Africa, took the next plane home. No late-stage equity materialized for these GAAC-scaled, unit-economic-deprived businesses.

How to Make it as an Investor in Africa

As negative unit economic businesses like WeWork and Uber fall out of favor in the U.S., an Acumen-backed report on exits in the PAYG energy and asset finance space, released last month, articulates why that model was never going to work in Africa. The report highlights Africa’s lack of exit paths – cash-rich strategic acquirers or IPO markets that value startups commensurate with private venture capital valuations. In PAYG solar, large utilities and traditional oil and gas players have emerged as potential exits, but they are unlikely to pay the 6x+ revenue multiples coveted by earlier investors in the sector. Secondary buyers are also few and far between. Cheap debt to scale a proven business model doesn’t exist – a particularly acute problem in PAYG businesses. The Acumen report’s key recommendation? A shift from GAAC-scaling to profitability, which is already underway with those players left standing.

In the meantime, GAAC-focused venture investors will continue to damage more sectors if left unchecked, and there are already plenty of casualties. Andela shifted its business model in search of profitability, WeWork was run out of the IPO market and Uber’s stock is off 25% from its high (though this is not quite as much as Jumia, which now trades at a fraction of its IPO price). As earlier-stage startups in Africa pursue GAAC-scaling in a misguided belief that they are special, the risk of a depression in the nascent venture market is real. If general partners investing under these auspices don’t do well, it will sour foreign LPs on future funds – and potentially on Africa as a whole. Capital scarcity will return as the main attribute of Africa’s startup community, and entrepreneurial ecosystems will be choked off before they had time to flourish.

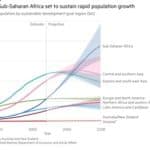

This doesn’t have to be the case. I wouldn’t have spent nearly a decade betting on sub-Saharan Africa if that scenario was inevitable. Regardless of the challenges of investing in the region, here’s one thing I know is true: The 54 countries in Africa represent a 1-billion-person opportunity, the majority of whom are young, tech literate and ready to work. Multinational acquirers already acknowledge this. But if startups and their investors want to join in, eager to take advantage of a macroeconomic bonanza, they must recognize the shortcomings of the GAAC-based values system. As those values prove false in Silicon Valley, the market of their creation, what alternative model should Africa and its frontier technology ventures adopt in their place? Eline Blaauboer of Africa Tech Ventures offers some thoughts here. My advice? CEOs should adopt long-term thinking and seek out investors that acknowledge and understand reality, forget the ego-boost of big rounds and press releases, and double down on building businesses that work.

Lauren Cochran is Managing Director at Blue Haven Initiative.

Photo courtesy of sharonang.

- Categories

- Investing