Expanding Impact and Emerging Risks in Off-Grid Energy: 10 Customer Insights – And Five Calls to Action

Social impact measurement is often a balancing act. On the one hand, we want rich, meaningful insights that reflect reality on the ground. On the other, if we get too granular and specific, we can get lost in the details and be unable to compare results or reach broader conclusions.

At 60 Decibels, the technology-enabled social impact company spun out of Acumen, we’ve been walking this tightrope for more than five years. We’ve been resolutely focused on listening better to end customers and beneficiaries, while also keeping an eye on, and helping shape, the broader global trends in impact measurement. Our ultimate goal is to bring the two together: to show how to systematically integrate customer voice into comparative measures of social impact.

This week, with the publication of our first impact performance report, we have our best example yet of how to strike this delicate balance. This report, titled “Why Off Grid Energy Matters,” is a deep dive into the impact of off-grid energy. To create the report—sponsored by CDC Group, Acumen, Efficiency for Access Coalition and Shell New Energies—we spent three years completing more than 35,000 interviews with customers of 49 off-grid energy companies in 17 countries.

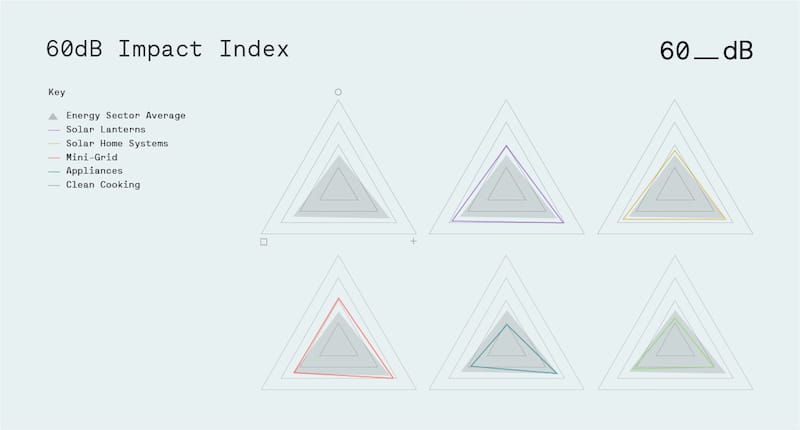

Not only did we learn amazing, hyper-specific things about the impact of each company on each individual customer’s life, we also turned this rich customer data into a first-of-its kind 60 dB Impact Index that creates like-to-like comparisons across companies and sectors. We hope this Index is a first step towards more robust comparative impact performance.

We are focused on this goal because if we can reliably compare the social impact created by two (or more) different companies, we can more easily assess things like social impact per dollar invested, and the correlation between social impact and financial viability. Ultimately, this will help us determine where to direct scarce investment dollars to create the greatest impact.

We also uncovered some of our richest findings to-date about the impact of off-grid energy. Our data show the profound positive impact that current off-grid solutions are providing to customers. We also identify important risks and gaps that need to be addressed for the sector to reach its full potential, both now and in the future.

At a sector level, the report shares the following 10 key insights:

- Positive impact: Time and again, customers report significant, positive social impact thanks to access to off-grid energy – better lighting, improved well-being, decreased kerosene usage and improved safety.

- The poorest customers are still left out, putting SDG7 at risk: The sector is not as inclusive as it could be, potentially limiting progress towards SDG7 – just 37% of off-grid energy customers we spoke to live in poverty, versus 60% of the population in the countries we studied.

- Companies are moving upmarket: As companies grow, they move upmarket and focus less on low-income customers as a proportion of their customer base.

- Mini-grids show great impact promise: Compared to other products, mini-grids serve the highest proportion of low-income families, and they continue this focus even as they grow.

- Solar lanterns are the greatest “impact value”: Compared to other products, solar lanterns currently provide the most impact bang-for-your-buck.

- We need to engage women more: The sector could do more to serve women – 68% of energy customers are men, and in 58% of households it was a man who first heard about the energy product or service.

- Income generation: Energy access is being used for income-generating activities for 1/5th of customers.

- Decreased kerosene use: Kerosene and other traditional fuel use for lighting is dropping, contributing to better health outcomes and decreasing CO2e emissions by half a ton per year.

- Quality and after-sales support remain a big issue: Product quality and customer service still need to improve – 34% of customers report challenges using their energy product or service.

- Payment burdens are growing: Over-indebtedness is a small but significant issue to customers, with 4% of the families we spoke to saying that their energy payments were a “heavy burden,” and 5% forced to regularly cut back their food consumption in order to make payments.

Based on these results, we recommend five specific calls to action for major industry players:

- Companies should continue to invest in product affordability: While the sector has made great strides in providing high-quality products at affordable prices—and put them more within reach with aggressive financing—the relatively low proportion of low-income customers overall means that product affordability must continue to improve to make these essential products accessible to all.

- Companies and industry bodies should keep an eye on over-indebtedness: While the number of customers we surveyed who struggle to pay for their off-grid product or service is currently only 4%, this number could increase quickly as companies sell and market more aggressively. In addition, many of those who struggled the most have stopped paying and/or had their products repossessed – so the problem is likely greater for them. Consumer protection laws and ongoing data collection to monitor customer hardship will help the sector grow in a responsible fashion, in ways that limit negative impacts on the very customers these companies aim to serve.

- Funders and companies should have a deeper focus on gender balance: While many of the firms we studied have made significant commitments to improve their gender inclusivity, it’s striking that almost 70% of their energy customers are men, and that in almost 60% of households, it was a man who first heard about their energy product or service. Additionally, we found that in 61% of cases, a man made the decision to buy alone. The good news; in most households, women have access to use the product. Indeed, our data also show that the impact of these products on women appears to be greater, and that the Net Promoter Score® (i.e.: people’s response to the question, “How likely is it that you would recommend this product or service to a friend or colleague?” on a 0 to 10 scale) for female customers is higher. This suggests that designing and delivering with women in mind too could have positive impacts on sales.

- Companies should more actively address and resolve customer challenges: As mentioned above, the percentage of customers reporting challenges using their energy product is high (34%). Moreover, for most companies, after-sales support is not adequately resolving these issues. This results in customer frustration, and it means that the full impact potential of these products is not being realized. Companies should continue to invest in improved product quality, increased training and more customer service support. This will build trust in the market and, equally importantly, will protect against impact risk: A broken solar product does not create any positive social impact – in fact, it’s likely created negative impact given that a family has spent money on it. In addition, as the off-grid market matures, creating a strong culture of effective after-sales support – and an operating model to facilitate it – will be critical.

- As a sector, we should invest in the viability of mini-grids, supported by stronger partnerships. Mini-grids show the most potential for inclusivity and impact as they grow. That said, they are dwarfed, in terms of customer reach, by solar lanterns and solar home systems. We believe that mini-grids could be an important part of the long-term solution for off-grid energy customers. But this will only happen with strong partnerships between businesses, investors and the public sector, supported by concessionary capital to allow companies to serve the hardest-to-reach customers and communities. One example of this type of collaboration is the Rockefeller Foundation’s Smart Power for Rural Development initiative, which is now being scaled up through a partnership with Tata Power. Seeded by significant grant capital, this program, now led by TP Renewable Microgrid, aims to build 10,000 mini-grids in India to serve 5 million households and reach 25 million people. We need more initiatives at this scale.

The “Why Off Grid Energy Matters” report provides robust customer data that can accelerate this progress, while helping the sector avoid pitfalls that could hinder its growth or limit its impact. This research is just the beginning of what we can do and learn, as we walk the fine line of listening as hard as we can to customers, and then aggregating the insights they share. This process will allow us to hear, with more confidence and clarity, the communities we’re serving, and to act upon this data for the benefit of customers, our sector and the world.

Kat Harrison is Director of Impact and Sasha Dichter is Co-Founder at 60 Decibels.

Photo courtesy of Acumen.

- Categories

- Energy, Impact Assessment