Marketing Nutritious Food Products at the Last 100 Meters: A New Report Explores the Impact of Direct Sales Forces

Nearly 800 million people globally are considered undernourished, and over 2 billion lack year-round access to adequate food. Many well-intentioned companies have attempted to address this issue, designing and selling affordable, nutritious products in developing countries. But unfortunately, these companies often forget one factor that is key to achieving their impact goals: Nutritious food products must be consumed frequently and consistently in sufficient quantities to produce positive health impacts. This in turn requires food companies to create consumption routines for consumers, while ensuring constant product availability. While penetration (i.e., the percentage of potential consumers who actually consume their products) has always been a key metric for food companies, few of these businesses focus on ensuring high consumption frequency for their products – including the companies marketing nutritious foods.

In the urban areas of developing countries, there are multiple distribution channels located a few hundred meters from customers’ homes, schools or workplace, where they tend to shop on a daily basis. Whether they are shops, street vendors or small restaurants, we refer to these channels as working at “the last 100 meters.” Among these channels, direct sales forces can be uniquely placed to trigger consumption frequency given the frequent, direct interactions they enable with customers. But what are direct sales forces’ true benefits? Can they really be a worthwhile investment for food brands? And if so, what best practices can turn them into cost-effective volume drivers?

In this article, based on a new report by Hystra leveraging research funded by the Bill & Melinda Gates Foundation across 14 organizations, we’ll propose a new way of thinking about distributing nutritious foods and other beneficial fast-moving products for low-income customers, focusing on consumption frequency rather than just penetration. We hope that this discussion can provide some preliminary answers for people and organizations looking to make a positive impact through the sale of nutritious foods and other repeat-purchase products to low-income consumers.

The Benefits of Direct Sales Forces for Selling Nutritious Products

A direct sales force can play several roles in the marketing of nutritious products – both at launch and at steady state (i.e., once sales are occurring regularly) – while remaining cost-effective. Traditional distribution channels at the last 100 meters (e.g., informal street vendors and retail shops) tend to sell multiple products that are already in demand. They rarely have both the skills and the will to create consumer demand for new products, especially when those are more expensive than basic products – as is often the case for nutritious foods.

Against this backdrop, a specialized direct sales force can be an effective channel to launch new products, by helping to:

- Fill value chain gaps with their own dedicated equipment (e.g., coolers in places without appropriate cold chains), which is necessary to deliver the product in its best condition, as Grameen Danone initially did when selling their yogurts in rural Bangladesh;

- Replace (at least in part) the media marketing spend required to encourage uptake of nutritious products, by doing activation – e.g. proximity marketing – while selling, as proven by FanMilk’s launch of its FanPrime fortified frozen dairy products through a dedicated women sales force in Nigeria;

- Gather early consumer insights on the product, allowing for rapid adaptation, as tested during the launch of various MERIEM products in West Africa;

- Leverage direct interactions with potential consumers to establish a consumption routine, as proven by the direct sales ladies of Nutri’zaza in Madagascar, who deliver warm porridges in low-income areas every day around breakfast time.

At steady state, a direct sales force can be maintained or added alongside informal retail if it brings a complementary long-term value (e.g., home delivery or ready-to-eat products) that offsets its costs to the product distributor or manufacturer. A direct sales force alongside retail can also enable the company to reach specific, previously underserved consumer segments with food products aimed at their unique needs (e.g., products focusing on pregnant and lactating women). For instance Bel Group, with its Sharing Cities programs, started distributing its dairy products through existing street vendors in various cities in developing countries specifically to better reach low-income consumers, who rarely go to the modern retail outlets where the products were already available. According to Alexandra Berreby, Inclusive Business Director at Bel, this approach “creates equity for our brand and helps us gain new clients, because when people see it in their own neighborhood, they know it’s a product for everyone.”

However, building a direct sales force remains a costly and complex investment. Piggybacking on suitable, existing sales networks, as Bel has done with Sharing Cities, can save time and money. But to make this a success, the network’s existing product offering needs to be a good fit for the additional product. If the additional product is completely new, sales agents must also have credibility in their communities, and they must be able to dedicate time to activation activities. Piggybacking on existing networks is thus a more appropriate solution for mature products and brands than for new ones that require dedicated activation.

Direct sales forces require a new, holistic view of accounting

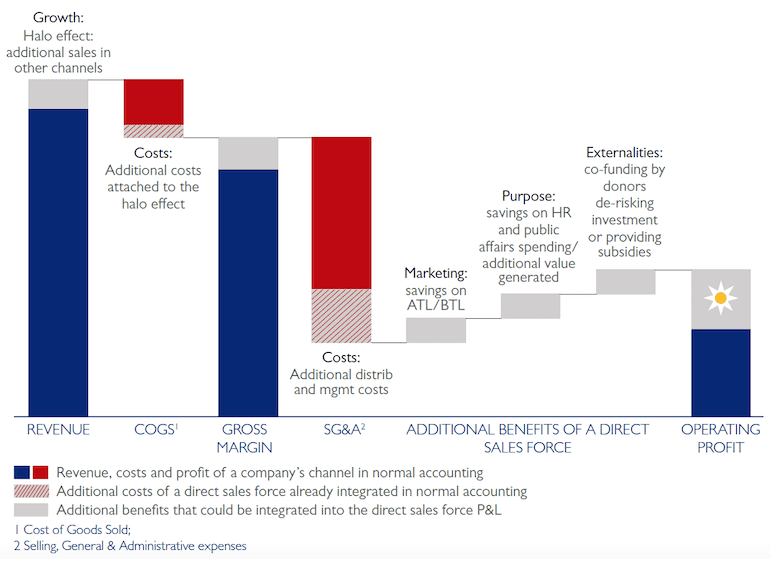

The traditional profit and loss statements of food companies do not do full justice to the costs and benefits of direct sales forces, as they typically only account for additional (human resource and distribution) costs compared to sales via traditional retail – but do not account for their additional, less easily quantifiable benefits. We have thus developed a tentative, more holistic accounting framework that considers these additional benefits and costs, as summarized in the graphic below. Its goal is to help food companies considering their channel mix to make more holistically informed decisions about which channels to sell through.

Direct sales force holistic accounting: A new way to look at profit and loss

From left to right on the graphic, these additional benefits and costs (in grey) include:

- Additional sales volumes (on the left): A direct sales force can create additional revenues beyond its direct ones by generating greater sales volumes in other channels (via the “halo effect,” in which the brand stays top-of-mind for customers, which creates a “halo” of additional sales at other sales points), as experienced by several Danone direct sales force projects.

- Additional costs of goods sold (COGS): These represent the costs of the additional products sold via the halo effect.

- Additional selling, general and administrative costs (SG&A): Direct sales forces have similar-to-higher SG&A costs than traditional retail, in particular due to the higher management costs of these sales forces.

- Savings on specific costs or additional margins (on the right): These more-indirect benefits include reduced marketing spend thanks to the activation role played by agents. For example, Bel Sharing Cities does not allocate any marketing costs to its direct sales force channel, since the sales force itself provides brand visibility. The benefits also include reduced HR and public affairs spending (or improved brand equity) due to the sense of purpose and positive image brought to employees and customers by working with local sales agents; and the possibility of external funding from donors interested in the sales model’s impact potential.

Perfect execution: The key success factor for a direct sales force

Choosing the right distribution strategy for greater consumption frequency is only a first step: Execution is where the hardest challenges lie. Learning from companies in the nutrition sector and beyond, we have gathered best practices in building a high-performance direct sales force that allows companies to reach both their business and impact goals while remaining cost-effective. A few of these practices include:

- Identifying the best candidates from the start: This can be done by encouraging peer-to-peer recruitment and by adapting recruitment criteria based on an analysis of existing best-performers’ profiles. Ajaita Shah, CEO of Frontier Markets, a social e-commerce platform in rural India relying on women agents, explains that the company performs this analysis “to know the set of criteria that make you effective and make you a rock star,” and translates it into future recruitment criteria for its sales forces.

- Giving everyone a fair but short chance: Keeping agents who do not perform well for too long wastes management time and damages brand reputation. For instance, Nutri’zaza has implemented a zero-fraud policy for its agents on the quality of its fortified porridge for children in Madagascar. They found that the most effective way to limit fraud was to enforce strong and immediate sanctions, i.e, removing 100% of the agent’s sales commission at the first sign of fraud, and dismissing the agent after three cases. This resulted in instances of product fraud dropping from 50% of agents in 2013 to less than 1% in 2018.

- Ensuring the constant development of agents’ performance: This can be achieved by offering hands-on management through frequent interactions with agents, and by prioritizing peer learning. For example, FanPrime, FanMilk’s fortified dairy product brand in Nigeria, organizes weekly discussion meetings between direct sales agents and their managers, in which sales agents share tips and celebrate their successes.

- Retaining best performers through meaningful financial and non-financial incentives: For example, Bel Sharing Cities provides health insurance to the street vendors that distribute its dairy products once they hit a certain number of monthly sales and sustain those numbers across several months – a benefit that most street vendors could not otherwise access.

- Directing sales agents’ efforts towards the company’s key success factors, by evolving incentives in line with the company’s objectives: FanPrime has done this by setting up phased incentives for agents, with objectives that evolve with their experience as well as the market’s maturity, and new benefits becoming accessible only once agents have reached and maintained a certain sales rate.

We hope that these insights – and the more detailed examples found in this new report – will help organizations that serve low-income consumers to increase not just their sales, but also the impact that their products can have on the people who need them most.

Lucie Klarsfeld McGrath is a Partner at Hystra and co-founder of the Global Distributors Collective. Louise Berthault is a Consultant at Hystra.

Photo courtesy of Carsten ten Brink.

- Categories

- Uncategorized