Supplemental Safety Net: An Innovative Model Paves the Way for Inclusive Insurance in China

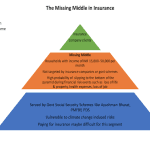

Despite rapid economic growth that has benefited many, hundreds of millions of people in China still remain outside the formal financial system without access to safe and affordable financial products. One of the biggest unmet financial needs is insurance. Salaried and wage-earning Chinese workers sometimes have insurance through their jobs, but many employees, especially those in social services, are severely underserved, and casual or self-employed workers are likely to have no coverage at all. China’s government recognizes that its current efforts to build a basic social security safety net can be complemented by private insurance expansion. The challenge—hardly unique to China—is how to make the commercial insurance market work for large numbers of the country’s large population of low- and moderate-income households.

YiBao, an insurance research, development and marketing consultancy, was created to scale up coverage among China’s vulnerable population segments. YiBao’s founder, Zhou Ling, had run public welfare organizations since the early 2000s, and prior to that had been an elementary school teacher in a rural village. Her professional experiences gave her first-hand insights into the situation of low-income, low-protection segments including rural teachers, disabled people, migrant workers and people who remained in rural areas after family members migrated to cities. Those five groups alone amount to some 600 million people in China.

Prior to launching YiBao in late 2014, Zhou Ling spent a year consulting with insurance executives. She discovered that the insurance industry tends to focus on more affluent population segments in part because reliable market data is much harder to obtain for lower-income segments. Without such data, insurers can neither design responsive products nor market effectively to lower-income segments, even though they represent a much larger potential market.

So Zhou Ling designed YiBao’s model to work in partnership with charitable organizations. For one thing, employees of those organizations tend to be financially vulnerable themselves, with low incomes, low levels of household savings, and insufficient insurance coverage. YiBao’s customer base in its first two years has consisted primarily of charitable organizations’ volunteers, staff members and their families.

Along with providing the initial customer base, charitable organizations serving low- and moderate-income populations also provide YiBao with valuable grassroots insights into those populations’ priority needs for insurance. YiBao analyzes that information and advises insurers about how to design the most responsive products, receiving a commission (usually 10-15 percent) on the resultant policies sold. YiBao also uses its own resources for promotion and sales of the insurance products, relieving the insurance companies of one of their biggest operating expenses. That major cost savings is passed on to the low-income consumers in the form of more affordable premiums which in turn means more policies sold. The number of people reached with YiBao products more than doubled between 2015 and 2016. By the end of 2016, after less than two years of YiBao’s existence, more than 21,000 people had received coverage, and the equivalent of nearly USD $92,000 had been paid out. Final 2017 growth figures are likely to be even higher.

Although its business model is still being refined, YiBao is poised for success in the future for several reasons:

- Distribution: YiBao works through existing community-based organizations, opening up distribution channels that will allow them to engage hundreds of thousands of people via a trusted source.

- Product Innovation: YiBao is committed to product innovation based upon unique insights. For example, they developed a new type of group insurance specifically for autistic children, who are typically uninsurable. The YiBao team learned that although all schools are required by law to carry insurance for all students, when accidents do happen, the law also pits the schools and the parents against each other in a fight to determine liability. So YiBao developed a new product where the students are covered regardless of whether they are in school or not at the time of the accident. This solves a real problem for the community, and the pricing is such that parents and schools can both share the cost of the coverage. So far over 6,000 children have been covered by this product.

- Digital Technology: China, like the rest of the world, has come a long way since the days when mobile phones were a luxury exclusively for the well-off. Every year the price of digital technology drops and the quality and accessibility improves, opening up huge opportunities to serve low-income people with digital financial services. YiBao is working actively to improve their IT systems so that they can provide better service to all their customers. They are establishing internet sales channels, using PC-based and mobile platforms, and are conducting marketing and promotion campaigns via WeChat, the Chinese social media mobile app that boasts 980 million active monthly users.

YiBao’s strategy calls for reaching massive scale by expanding its intermediary role to include public/private collaborations. Government ministries have significant resources at their disposal for the protection and financial aid of low-income, vulnerable groups. But the staffs of those ministries are not experts in insurance product design or delivery, making them reluctant to engage directly with insurance companies. YiBao plans to act as a specialized third party, brokering collaborations to design and develop insurance products for which the government can provide funding. These products will safeguard the health and stability of the low- and moderate-income majority, a vital public objective on which China’s continued economic performance depends.

YiBao believes that its model can scale up to serve a significant share of the uninsured and underinsured households in China. They also hope it can provide a useful blueprint for other nations seeking to make insurance markets work for the majority.

In honor of its breakthrough potential, YiBao was awarded MetLife Foundation’s Inclusion Plus China award in January 2017, using the prize money to expand its data-gathering and research efforts about China’s low-income populations’ insurance needs. This short (2:45) video reviews the InclusionPlus China contest; this one (1:30) features YiBao founder Zhou Ling. Learn more at www.yibaojihua.com. (Note: MetLife Foundation is a NextBillion partner.)

Lee Ng, Ph.D., is vice president and chief operating officer of Innovation at MetLife’s Innovation Centre (LumenLab).

Sarah Willis is a program manager at MetLife Foundation, where she manages a global portfolio of financial inclusion initiatives.

Photo by Matt Barber via Flickr.

- Categories

- Health Care