The UBI Debate: What We Know – and Don’t Know – About Universal Basic Income

Everyone seems to be talking about universal basic income (UBI). From Nairobi to Silicon Valley to Utrecht, development professionals, investors and policymakers are converging on UBI as a potential solution to poverty and unemployment.

Technology is one reason that solutions are desperately needed. In advanced economies, automation has already begun to displace workers in industries like agriculture and manufacturing. While this is not the first time time major technological advancements have been accompanied by dire predictions of job loss, there are reasons to believe the pace and nature of technological advancement might really be different this time. The fate of displaced workers and the prospects of growing inequality within high-income countries is a serious economic, political and social concern, warranting consideration of novel, potentially disruptive policies in response.

Another reasons is that, despite massive reductions in poverty worldwide, more than 760 million people – more than 10 percent of the world’s population – still live on less than $1.90 per day. Policymakers are searching for solutions to help these adults and children rise out of extreme poverty and meet their basic needs.

There are also concerns about the effectiveness and efficiency of the complex network of services that make up the social safety net in high- and low-income countries alike.

For all these challenges, UBI could be part of the solution.

UBI DEFINED

Universal basic income is, as its name suggests, universal. That means that all individuals in an area – a country or a region, for example – receive it, regardless of income, employment status or other eligibility factors. It is also unconditional, meaning individuals are free to spend or save the funds as they wish. The amount is intended to be sufficient to meet basic needs and ensure that no one falls below a given poverty line. It resembles income in that it is paid regularly and over the long term.

While UBI has not yet been rolled out on a truly universal scale with public funding, in principle UBI would be redistributive. Like any social program, there are two main ways a government could finance UBI: taxes on the wealthy or savings from reducing expenditure on other social programs (in the U.S., programs like SNAP or the earned income tax credit, for instance).

THE DEBATE

There are many historical precedents to the idea of UBI. Notably, legislation proposing a negative income tax – a close relative of UBI – passed the U.S. House of Representatives but failed in the Senate in 1971. Today, proponents and skeptics of UBI come from both sides of the political spectrum.

Those who favor UBI suggest that it could simultaneously reduce poverty, give autonomy and flexibility to recipients and recognize forms of unpaid labor disproportionately performed by women. It could improve the efficiency of an otherwise piecemeal and in-kind social safety net and could take the place of regulations (like the minimum wage) that might lead to labor market frictions. UBI could also eliminate the thorny targeting issue inherent in all social programs – the arduous process of determining who is eligible – and it would remove the cost of enforcing conditions inherent in conditional cash transfers. To many, UBI may be part of the solution in the seemingly intractable fight against poverty.

Detractors, however, suggest that UBI is too costly to be feasible on a national scale. They fear that providing a regular basic income could discourage people from pursuing productive employment and that it could lead to irresponsible spending on things like alcohol or gambling. Political questions also challenge the implementation of UBI: What can governments do to avoid the backlash that might result from rolling back existing social programs? And how can we be sure that all recipients, from well-connected city-dwellers to rural farmers who own neither a bank account nor a cell phone, are able to receive their payments on a consistent basis?

ONGOING RESEARCH

So, who is right? Evidence from completed and ongoing randomized evaluations, also known as randomized controlled trials (RCTs), can help cut through this debate. RCTs are a rigorous type of impact evaluation that allows researchers to identify the causal impacts of a program or policy. In other words, they allow us to see how effective a given solution was at reducing a given problem. Around the world, researchers are conducting impact evaluations that can inform the UBI debate with rigorous evidence. At J-PAL, we work with economists and political scientists who conduct randomized evaluations on a range of social policies in different sectors, from health and education to governance and finance.

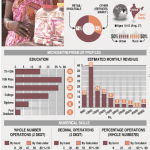

In Kenya, for instance, the NGO GiveDirectly is delivering UBI to 6,000 people in 40 villages and has been for 12 years. They have partnered with a team of researchers, including several affiliated with J-PAL, to test the impact of UBI on household income, assets and investments, how people spend their time, and people’s health and well-being. Across the full study, which is testing several different approaches to reducing poverty through unconditional cash transfers, GiveDirectly is working with 300 Kenyan villages.

As entire communities have been randomly assigned to receive UBI, this is the first RCT of a truly universal transfer, which will allow researchers to answer important questions about the impact of transfers on wages and labor markets at the community level. The 12-year duration of the GiveDirectly program will shed light on the impact of reliably receiving a basic income-sized transfer over an extended period of time.

In addition, several pilot studies of UBI are ongoing in Canada, Finland, the Netherlands and in California, among others. Taken together, the results of these studies will help us understand the impact of UBI on households and communities in multiple contexts and in the long term.

What We Know

While impact evaluations of UBI are ongoing, there is much we already know to help inform the debate.

First, there is consistent evidence from around the world that when people receive cash with few or no strings attached, they do not waste it, nor does it discourage work.

Across seven RCTs of conditional and unconditional cash transfer programs in six countries, there is no evidence that cash discourages work. In Kenya, unconditional cash transfers delivered by GiveDirectly (in a study that took place before their ongoing UBI study began) led to increased consumption and investment, improved happiness and life satisfaction, and no increased spending on alcohol or tobacco among households that received lump-sum transfers.

In Uganda, unsupervised cash grants for young entrepreneurs led to increased investment, time spent working and income, even up to four years later. Taken together, this evidence suggests that concerns about recipients spending cash irresponsibly may be misplaced.

Second, if universal transfers are not feasible for fiscal or political reasons, the promising evidence on the impact of unconditional cash transfers could lead to an expansion of such programs targeted to those who meet some eligibility criteria.

Accurately identifying eligible individuals can be costly and challenging, but there is evidence on the accuracy of different approaches to targeting social programs. In Indonesia, researchers found that, while proxy means testing was slightly more accurate at identifying the poor, a community-based targeting approach led to higher rates of community satisfaction with the process. Self-targeting, which requires households who believe they are eligible for a transfer to spend time filling out an application for the program, was more effective than automatic screening at enrolling the poorest households in a community. Policymakers considering targeted cash transfers should consider this evidence when deciding among different targeting methods.

Third, much of the discussion surrounding UBI focuses on its potential application to reduce extreme poverty. While we wait for rigorous evidence on the impact of UBI on reducing poverty, we can turn to existing evidence on other proven strategies.

One of these is called the graduation approach, a multifaceted asset transfer program designed to help extremely low-income households transition from insecure wage labor to more reliable self-employment. Instead of transferring cash only, the graduation approach includes transfers of other productive household assets, like farm animals, together with personalized coaching, health care and savings accounts.

Across a diverse set of contexts and implementing partners, the graduation approach resulted in large and cost-effective impacts on ultra-poor households’ standard of living. Three years after participants received the asset transfer, researchers found that they had increased basic entrepreneurial activities and spent more time working each day, ultimately increasing their consumption, asset holdings, income, savings and food security.

The approach also led to some improvements in psychosocial well-being. In Bangladesh and India, where longer-term data is available, the impact of the graduation approach increased over time.

WHERE DOES THIS LEAVE US?

While we do not yet know if UBI or targeted cash transfers will have sustained positive impacts like those that have resulted from the graduation approach, we do know that cash does not reduce the time recipients spend working, nor does it increase spending on temptation goods. J-PAL affiliates Chris Blattman and Paul Niehaus have proposed that the aid community begin thinking of cash as a benchmark for aid programs. The additional cost of conventional aid or safety net programs is worthwhile only if the “active management” by development professionals or governments leads to greater improvements in outcomes than cash alone.

Today, the vast majority of development assistance is non-cash, so either expanding cash transfers or implementing UBI would represent a major shift in how aid is delivered. The ongoing impact evaluations mentioned above will help us see whether the encouraging evidence from studies of cash transfers holds true even when the transfers are universal, persistent and sufficient to cover basic needs.

While ongoing impact evaluations will help us understand how individuals, households and markets respond to UBI, these are only some of the important open questions policymakers will have to consider. Several key political and policy questions will remain: Would it be feasible to replace traditional cornerstones of the social safety net like Medicaid or food stamps with UBI? Would UBI establish a minimum income sufficient to remove labor market regulations like the minimum wage?

And, no matter what the ongoing studies demonstrate about the way individuals and communities respond to UBI, we must be realistic about what UBI can do. UBI cannot be a panacea for all development challenges. For instance, it will not necessarily address the psychological effects of being adversely affected by a changing economy. Communities will still need public goods like roads and vaccines, and functioning institutions will still matter – neither of which can be assured by cash transfers to individuals. (In fact, there are possible channels through which cash transfers could improve responsiveness of institutions; for instance, citizens may be more willing or able to participate in politics, or politicians may become more responsive when their constituents are better off. J-PAL’s Governance Initiative is funding a pilot study to test changing political engagement and local politician response to unconditional cash transfers in Kenya).

Rigorous evidence gives us reason to be enthusiastic about cash and cautiously optimistic about UBI, but results from ongoing research on UBI will be key to understanding the impact of this approach on individuals and communities. Only then, and only with careful consideration of the many remaining political considerations, will we be able to confidently identify the place UBI should occupy in a set of social policy options.

Alison Fahey is a senior policy manager at J-PAL and manages the organization’s finance sector and its political economy and governance sector.

Photo from the unconditional cash transfer study in Kenya, courtesy of IPA/J-PAL

[yop_poll id=”12″]

- Categories

- Uncategorized