Where Aggregators – and Open APIs – Fit Into Financial Inclusion

How might we best foster innovation in financial technology for low-income consumers, through products and services that promote digital financial inclusion?

Recently, the Bill and Melinda Gates Foundation and Financial Sector Deepening Trust Tanzania partnered with BFA (Bankable Frontier Associates) and Selcom, a Tanzanian payments aggregator, to explore that question by examining the detailed role and abilities of aggregators in the digital finance space. The goal was to determine which key pieces of the ecosystem could benefit from the development of strategic initiatives to utilize, develop or disseminate Selcom’s tools as Open APIs.

What truly sets digital payments aggregators apart from other digital payments players is not only the quantity and depth of connections they have to other institutions, but also the resulting increased freedom they have in combining these services to best serve the market.

With access to a wide array of banks and mobile money provider services, aggregators sit in a truly unique position to be able to offer products and services to consumers in an institution-agnostic manner, and often at a lower cost and/or greater value to the customer.

These connections are currently available to developers via Partner APIs (also referred to as Public APIs), which are software services that are exposed to the public internet, but require some custom partnering agreement or manual configuration process with the provider prior to gaining access. This differs from Open APIs, where each of these processes has been automated and requires no in-person meeting or manual configuration prior to use. An Open API, as described in detail in a recent whitepaper published by BFA and FSD Kenya, rewards a careful design process – including security, reliability and scalability – with a higher volume of transactions brought on board by third-party developers’ customers.

In Tanzania, Selcom’s “Billers Gateway” is a Partner API that provides payment channels for the most-used billers (TV services, electricity, etc.) to reach customers of all of the major mobile network operators (MNOs), while taking into account each player’s costs, revenues and existing business logic. Selcom exposes these services via a POS for their agents, through USSD and the PayPoint smartphone app for on-the-go consumers, and through their CashPoint ATMs for specific locations where challenges relating to cash liquidity, high volume or risk of theft are too great for an agent to take on.

Beyond exposing this sort of payment channel to consumers, aggregators also produce their own branded value-add products for the market. Selcom, as an example, has the Selcom Card, a smart card that can store value for tap-and-go transactions with the POS network. This opens doors to larger solutions like transit ticketing, offline transactions, government disbursements, and even web and in-app payments.

With all of these widely adopted pieces in place, however, the ecosystem – that is, the banks, the MNOs, third-party digital payments products, customers and aggregators like Selcom – would benefit even further from the development of an Open API solution. It is our belief that this process of “opening up” would be accelerated by providing Selcom (and other aggregators in similar positions) the necessary technical and financial resources to strategize around the key aspects of an Open API, including security, reliability, scalability, developer experience and marketing.

To better understand these assertions, we provide below a detailed tour of Selcom’s current position in the market and how they’ve structured their existing solutions around this position. This background will help detail how an Open API might be launched with an aggregator, and how fintech developers and financial inclusion experts can be encouraged to work together to make best use of these APIs.

Aggregators are FinTech Hubs

Selcom sits in a unique position within the payments space in Tanzania. Like aggregators in other regions of Africa, they sit in the middle of the institutions and key players typically associated with digital payments. This position allows for a number of notable advantages that can be passed through to their customers and partners.

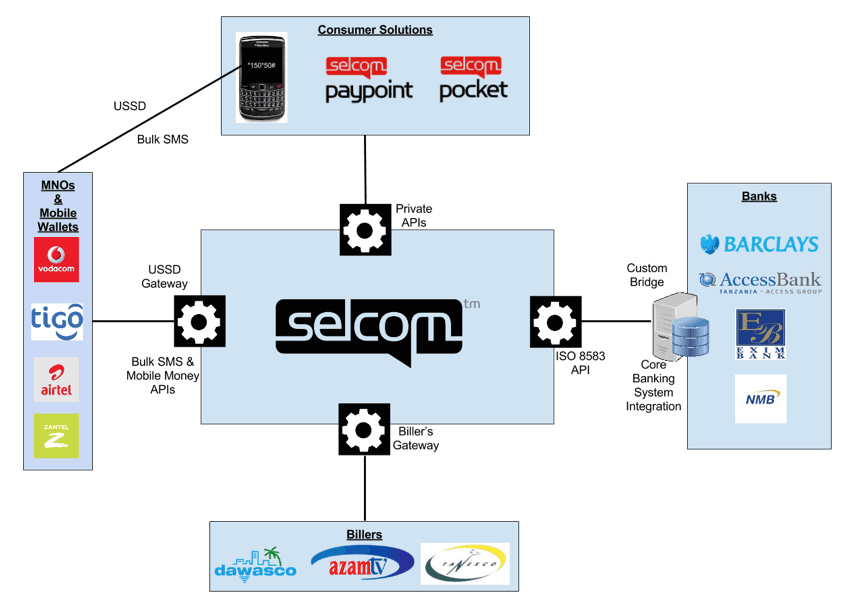

This chart shows Selcom’s position in the market and the technical connections the firm has built. The brands displayed are for the sake of example, and are not an exhaustive list.

First, Selcom’s platform is deeply tied into MNO services, including mobile money APIs. Selcom’s rich history of airtime distribution and cash-in-cash-out partnerships with each of the major MNOs affords them the ability to strengthen their technological ties as well. These ties provide the ability to instantaneously transfer value electronically between any wallets for retail or remittance transactions, and to provide bill pay and disbursement services.

On the other side of their platform, Selcom’s software backend is connected to a majority of the major banks across Tanzania. With specialized hardware placed directly in the banks to act as a translation layer between the core banking system and Selcom’s platform, Selcom is able to electronically request that the banks complete transactions on behalf of their respective account holders.

Finally, the platform exposes the aforementioned Biller’s Gateway, which is an API for partners through which existing utility companies and other bill collectors can integrate their collection and tracking software to accept payments. Any value received into Selcom’s network via bank deposit, mobile money transfer or cash, can then be channeled to the biller’s bank account or mobile wallet, regardless of the financial institution.

Generally, an aggregator platform like Selcom’s, and its flexible array of partner options, enables a few key items that aren’t necessarily feasible (or even available) within banks or MNOs themselves:

- Flexible business models: The partner institutions’ differing fee structures allow for the optimization of costs inherent to launching and sustaining new business cases around digital payments features and products.

- A tech toolbox: Through the MNOs, the aggregator has the ability to send bulk SMS messages, open USSD sessions, move value in the form of mobile money, and in some cases even access “know your customer” (KYC) information. Through the connections with the banks, they have the ability to move money in and out of bank accounts, and between banks, instantaneously. This smorgasbord of tools provides a flexibility that is necessary for innovation to occur.

- Channel-agnosticism: Because there are many partners, a single institution’s branding, marketing and cross-sell strategy impose fewer constraints than they otherwise would. Products can be tailored around the user experience first.

- In-house expertise: Once a partnership is formed, the aggregator’s API developers, market expertise and professional network could be made available in some form (e.g. forums, support chatrooms, engineering blogs, etc.) to assist with or co-develop products. This can save time and costs by removing the need for sourcing and transferring knowledge to the contracted development firms a bank or MNO may typically use.

Aggregators are Already Platforms

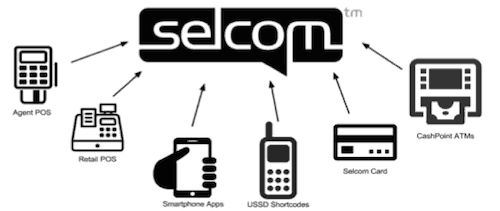

By treating these sets of digital connections as technical building blocks, Selcom has been able to put together a number of feature-rich, consumer-facing solutions around their hub. The aforementioned Selcom POS, Selcom Card, PayPoint smartphone app, USSD shortcodes for feature phones, CashPoint ATMs and the Biller’s Gateway API form an ecosystem around the hub. In this sense, Selcom already is a platform for innovative digital products.

The Selcom platform and surrounding product ecosystem.

Beyond their branded product line, Selcom has delivered on a number of bespoke solutions, ranging from custom USSD applications for savings groups to back-end financial products tailored to a specific value chain and delivered through their existing channels.

One example is a benefits distribution product that was used to reduce the time spent waiting in a post office to collect and cash a disbursement check. A custom Selcom product replaced the process of mailing checks to the recipients, by allowing the pension distributor to deliver the value via Selcom’s partner MNOs’ channels into the recipient’s mobile money wallet. This saves time for the recipient, postal workers, bank cashiers and those in charge of reconciliation and auditing. It also increases mobile money adoption and its associated benefits in a population that otherwise may not have been introduced to this technology.

The Case for Opening Up

There are several potential strategies for how these partnerships, products and platform features could be combined to better serve the financially excluded or underserved. Selcom’s position as a hub already allows them to potentially provide an added value in the form of data analysis and predictive machine learning models for risk scoring, AML/CFT, and the like. Their in-house development team allows them to build solutions like mobile and web applications for the market directly. However, one option maximizes the ability to promote innovation that may not otherwise be possible: Open APIs.

Selcom and other aggregators in similar positions are perfectly positioned to create a set of APIs for third-party developers to build on without disrupting the aggregator’s own core business nor that of their partners. In fact, since aggregators, MNOs and banks each make money on a transactional basis, they would all benefit from the extra volume through their channels that would result from third-party solutions. The customers of these services would also stand to benefit from the creation of startups focused on providing solutions with a richer user experience for a more focused set of problems.

While Open API payment services are just beginning to reach the developing world in the form of Stripe Atlas and the like, these services typically require credit cards or bank accounts to transact, and do not yet enable the sort of inclusion that mobile money does. So even with these new, somewhat competitive services accounted for, there is still a clear case for the aggregator-based Open API platform that connects to all of these services plus mobile money.

As mentioned earlier, opening up admittedly comes with a set of calculable risks. Thus Selcom and other similar aggregators could initially elect to expose a limited set of functionalities as an Open API while still providing an immediate benefit to each third-party merchant:

- Make a payment: Process a value transfer from any institution to any other institution (e.g. mobile money wallet, bank account or payment card)

- Check status: Check the status of a payment (e.g. authorized, voided, completed, reversed)

- Retrieve payment history: List a customer’s previous payments for reference and record-keeping

- Reverse/cancel a payment: Return funds transferred by a previously completed transaction, or cancel a transaction that is in progress

- Embed a user interface: An embeddable user interface – that can be dropped into mobile and web applications with a few lines of boilerplate code – to enable quick and easy integration for those looking to develop around common use cases

Getting over Initial Hurdles

With these pieces coming together, the introduction of a truly Open API is indeed an exciting prospect for individuals and institutions interested in financial inclusion – digital financial providers, economists, technologists and developers alike. Aggregators touch each of these roles, providing a platform for substantial impact in financial inclusion.

So, what would it take for an aggregator like Selcom to build a sustainable Open API business model?

The first step is to ensure that the Open API is technically sound. This means providing technical and financial resources to help examine and advise the security, reliability, scalability, developer experience, compliance with best practices, code libraries and samples for third-party integrators, and any other technical hurdles that may arise leading up to launch.

An equally critical step in the launch of an Open API is to connect the developer community to those with domain expertise. For low-income inclusion, this means connecting with the financial inclusion community to encourage collaboration on innovative solutions to build off the open platform. This may mean coordinating hackathons and similar events within the inclusive fintech space, which would provide an initial boost in recognition and adoption of the Open API, resulting in greater innovation and some flagship products to set the tone for what’s to come.

Matt Grasser is a senior associate at BFA.

Photo by FamZoo Staff via Flickr.

- Categories

- Finance, Technology