Agents Beat Mobile? Intriguing Research from MIX on Alternative Delivery Channels in Banking

Financial services providers focused on the unbanked have made great strides in expanding access to their services. For the past decade, credit providers have grown their client base by 20 percent annually, according to MIX Market data. And the number of those without an account dropped by 20 percent in less than half that time, with 62 percent of adults now financially included globally. To help them overcome the remaining obstacles to universal access, many financial service providers (FSPs) look to technology to enable new means of distribution. These alternative delivery channels (ADCs) include ATMs, mobile money, agent networks and other channels outside of branches. FSPs present on MIX Market confirm this trend; in a recent MIX survey, just over 60 percent of FSPs stated that they were already delivering services to customers through channels outside the branch.

While these channels are often grouped together, they differ not only in characteristics but also in how they have been adopted and deployed by FSPs. With the support of The MasterCard Foundation, IFC’s Partnership for Financial Inclusion and UNCDF’s MicroLead program, we researched and developed a set of metrics for FSPs to assess the performance of each channel and compare against the market. According to our findings, FSPs reported that 55 percent of their channel experiments and future plans involve either mobile phones or internet (including smartphone apps), highlighting the effects of new technology and changing consumer behaviors. Regardless of potential shifts ahead, though, agent banking remains the most commonly deployed ADC today.

Agents are defined as individuals or businesses entitled to act on behalf of an FSP to perform certain financial or administrative transactions. Often found in kiosks or next to cashiers in shops, agents are likely the most familiar ADC to clients. Similar to branches, clients are able to perform cash transactions with the assistance of an operator. However, whereas the geographic reach of branches is limited, agents are often closer to clients’ homes or places of work. Indeed, the agent might itself be a place where clients already shop. Perhaps because of this, agent networks dominate the channel mix for many FSPs.

Of all the channels, agents create the most new service points for clients, whereas other channels simply extend the branch network. As a group, ADCs contribute over five times more service points than branches alone, yet agents drive this multiplier thanks to service points that are seven times more numerous than the branches. As a result of their considerable physical presence, agents account for around 40 percent of transactions at FSPs where the channel has been deployed. By comparison, other ADCs carry low single-digit volumes, which are relatively negligible if this traffic is an indicator of client convenience. Additionally, enrollment rates at agents are much higher than at other ADCs. Whereas the total percentage of clients enrolled on either mobile services, ATMs or roving staff rarely exceeds 20 percent, agents report an 86 percent enrollment rate. Anecdotal evidence from more than one FSP we interviewed suggests that the agent channel not only attracts transactions formerly conducted at branches but also drives an increase in usage or number of transactions.

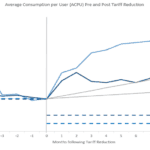

However, this does not mean that the agent channel is without its own set of challenges. Though the enrollment rate at agents is much higher than other channels, less than a third of those enrolled clients are regularly active. Additionally, while transactions at agents have the largest average amount of all ADCs, these are only slightly over half the average amount per transaction at branches. This indicates that clients may still rely on branches for large transactions due to existing behaviors, security concerns or awareness of services offered through each channel.

There is no doubt that alternative delivery channels are increasing access to a variety of financial services in both rural and urban areas. The ADC footprint, particularly agents, is scaling to provide greater geographic coverage to reach new clients and improve proximity to existing ones. The next step for FSPs is to measure the performance of each channel to develop the right strategies for the desired business and social outcomes.

To learn more, register for MIX’s April 27 webinar: Measuring the Performance of Alternative Delivery Channels.

Antoine Navarro is a financial inclusion consultant; Blaine Stephens is COO of MIX; and Nikhil Gehani is the marketing and communications manager at MIX.

Photo courtesy of the Institute for Money, Technology and Financial Inclusion, via Flickr

- Categories

- Uncategorized