Understanding Consumer Satisfaction in Low-Income Markets: The Factors that Turn Customers into Brand Promoters – or Detractors

Many companies are addressing social needs ranging from nutrition to reproductive health by selling affordable food, hygiene and other beneficial products in developing countries. But in order to produce positive impacts — and to provide a compelling business case for the companies that sell them — these products must achieve a sufficient level of consumer satisfaction. This raises some important questions: What factors drive the adoption of nutritious food products and quality consumer goods among low-income consumers? How does access to these products affect these customers’ quality of life? And what factors improve consumer satisfaction to the point where these customers are likely to recommend a product to others?

Bopinc set out to explore these questions for several products that we have helped make more available and accessible to low-income consumers, through our projects supporting companies’ inclusive innovation and/or marketing and distribution efforts. In partnership with 60 Decibels and Upinion, we conducted consumer-level deep-dives into the impacts of products we supported in Ethiopia, Bangladesh, Ivory Coast, Mali, Niger and Nigeria, obtaining insights from phone interviews with 765 consumers, and from in-person surveys of 422 consumers across 2021 and early 2022.

For the first time, we now have comparable data across several markets and projects, revealing what low-income consumers think about these products. In this article, we dig into the data we collected, in order to understand the key factors that shape consumer satisfaction.

The Role of Good Alternatives in Generating Brand Promoters and Detractors

A key question in these studies is whether consumers are satisfied with these products enough to recommend them to family, friends and neighbors. Consumers who say they are likely to recommend a product to others are considered “promoters,” and those who are unlikely to do so are “detractors.” These responses allow us to calculate each product’s Net Promoter Score (NPS). NPS is a widely used measure of customer satisfaction that helps us to compare and benchmark the performance of different products. The NPS score ranges from -100 to 100, and a positive NPS indicates that there are more promoters than detractors.

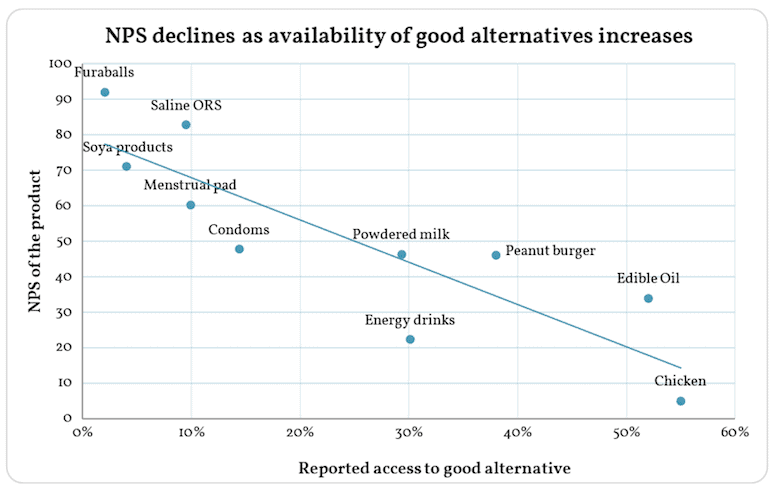

Another question we put to consumers was whether they could easily access good alternatives to the products our projects support. One insight that jumped out when we compared their answers to this question is that ease of access to alternative products is a driver of both product promoters and detractors. This relationship across product categories in our deep-dive studies is shown below:

Note: Data from consumer-level impact studies conducted by 60 Decibels in Ethiopia, Ivory Coast, Mali, Niger and Nigeria (cumulative sample size across the studies = 765) and Upinion in Bangladesh (sample size = 422), 2021 – 2022.

In the figure above, we’ve plotted the NPS for each of these products against the average reported access to good alternatives. Each dot represents one product category targeted to low-income consumers that Bopinc has worked to bring to market through one of our projects. In viewing this data, a clear trend emerges: The products consumers most enthusiastically recommend to others are those with few good alternatives. For instance, furaballs (a sorghum-based snack food popular in Northern Nigeria — see our earlier article on furaballs and their impact on consumers), oral rehydration salts (ORS) sold in rural Bangladesh, and soya-based milk and flour products sold in Mali all have very high NPS and very little competition from good alternatives. Indeed, their NPS ranged from the 70s to the 90s, and less than 10% of respondents in these deep-dives said there was a good alternative to these products available on the local market. It’s important to note that the perception of a lack of suitable alternatives does not necessarily mean that the product is new and without direct competitors on the market. Although this is the case with soya-based products in Mali, there are several ORS brands in Bangladesh, and many other vendors of furaballs (which can also be made at home) in Nigeria. Yet consumers in the study reported that they do not have alternatives as good as the products supported through Bopinc projects.

At the other end of the trendline is broiler chicken marketed in Niger. The product only has an NPS of 5, and 55% of its consumers said that they could easily find a good alternative to it. The fact that most consumers do not see the product as different from other alternatives is a likely reason for its relatively low NPS.

Consistent Availability and Quality also Matter

Though this data suggests that a lack of good available alternatives is a driver of high NPS, that’s far from the only thing low-income consumers care about. Our results highlight other aspects, like consistent availability and high quality, that keep consumers satisfied and motivate them to recommend products to others. Looking more closely at products with differing NPS but similar levels of competition from alternative products helps shed light on these additional consumer priorities.

For example, the ORS and the menstrual pads brands supported under different Bopinc projects have the same reported access to good alternatives (10%), but they have very different NPS (ORS: 83, menstrual pads: 60). This difference in NPS despite similar reported access to good alternatives can be explained in part by two other factors: consistent availability and high quality. Our data shows that the oral rehydration salts brand was deemed to be “always available” by 83% of consumers, and “of better quality” by 80% of people who used them. On the other hand, the menstrual pads brand was considered “always available” by 72% of consumers and of “better quality” than alternative brands by 69% of consumers. The comparison of consumer perceptions of these two products indicates that the ORS brand scored higher than the menstrual pads brand on both availability and quality parameters. Therefore the consistent availability and quality could also explain the difference in NPS, along with access to good alternatives.

These results underscore the fact that consumers appreciate it when companies bring new or differentiated products onto the market, especially when similar products are hard to find in the areas where they live. Saline ORS in Bangladesh, furaballs in Northern Nigeria and soya-based milk and flour products in Mali are all good examples of products we’ve supported that have few comparable competitors and earn enthusiastic reviews from consumers. We’ve also seen in earlier research that many of these products are highly impactful and drive positive changes in the quality of life for low-income consumers.

So what’s the takeaway for projects or businesses seeking to bring beneficial products to low-income consumers in underserved markets? Impact can be created by supporting beneficial products that meet the unfulfilled needs of these consumers. But that’s not enough. To maximize consumer satisfaction, it’s essential to ensure that these products also have an edge in terms of quality, and that they are consistently available to consumers when they need them. This is critical to building a business case for products that improve the lives of low-income consumers and their families.

Rakib Hasan Rabbi and Patrick Guyer are Impact Measurement Managers at Bopinc.

Photo courtesy of Nestlé.

- Categories

- Impact Assessment