An Overlooked Path to Health Impact: Four Tools to Increase Consumption Frequency for Beneficial Consumer Goods

Fast-moving consumer goods companies traditionally focus their marketing and distribution efforts on maximizing the penetration of their products – i.e., the share of their target consumers who have purchased a product in a given timeframe. The implicit assumption is that increasing penetration is key to driving sales growth.

However, in doing so, they overlook a critical metric: consumption frequency. Addressing this metric is crucial because the typical consumer purchases surprisingly few fast-moving consumer goods products per year – including of the most popular brands. For instance, 35% of Kellogg’s Frosted Flakes buyers in the U.S. only purchase one box of the cereal per year, while 30% of Coca Cola buyers do not even buy once a year, with just 4% of buyers accounting for almost 25% of total Coke sales.

Not only can increasing consumption frequency drive growth, it is also essential for products like nutritious foods which can only deliver health impact if they are consumed every day or every other day. This requires companies to ensure constant product availability via an effective distribution strategy, as we discussed in our recent NextBillion article on “Marketing Nutritious Food Products at the Last 100 Meters.” But focusing on distribution is not enough: A well-planned marketing strategy is also required to ensure consumers’ recurring willingness to purchase these products.

This article presents four tools to motivate consistent and frequent consumption patterns among low-income consumers. They are based on the Consumption Frequency Toolkit developed by Ogilvy and Hystra within the Growth for Growth program supported by the Bill & Melinda Gates Foundation. We hope that these tools will help companies achieve their sales growth goals, while delivering the consumption frequency required for nutritional and/or social impact at scale.

Tool #1: Resetting your assumptions about low-income consumers’ purchasing habits

Before devising a new strategy, you should consider the potential assumptions affecting the way you and your teams currently think about low-income consumers and malnutrition. We have found that everyone from top executives in food companies to nutrition experts working in the non-profit sector can fall prey to some of these four myths:

- Myth 1: Only low-income quintiles suffer from malnutrition: Actually, undernutrition is also present in more affluent quintiles in lower- and middle-income countries around the world. For instance, 25% of children from the wealthiest quintile suffer from stunting in India, 26% in Bangladesh and 30% in Ethiopia. As a result, fortified products or campaigns against malnutrition should not only target lower-income consumers but also their wealthier counterparts to maximize impact – potentially even starting with these higher wealth quintiles to create aspiration (and ease initial cost recovery).

- Myth 2: Health benefits drive food purchases: If this were true, we would all have far healthier diets! Lower-income families, just like the rest of us, will usually tend to seek pleasure, aspiration and convenience when buying everyday items. They are even ready to pay more to get these (non-health related) benefits. For instance, some rural Indian consumers are willing to pay two to five times more for the convenience of having water delivered to their homes, compared to the price at water kiosks.

- Myth 3: Low-income consumers need cheap products: In fact, they tend to look for risk-free, holistic solutions, and often choose the “best they can afford” option. For example, low-income families are willing to pay five to eight times the price of basic flour for a fortified infant flour product, once they are convinced it will be better for their children.

- Myth 4: Consumers need to be educated on products benefits: Many of them are actually already aware of the theoretical health benefits of nutritious or other life-improving products. However, what they lack is trust in these products’ quality itself, and thus they remain unconvinced that the products will truly deliver their intended benefits. For example, after a health campaign on improved cookstoves, 69% of potential buyers were aware of their positive impact on health – but only 2% purchased such a stove – and 88% explained afterwards that they did not buy because they did not trust the product benefits. The same applies to nutrition, where creating trust is key to convincing consumers to change their diets.

Tool #2: Selecting the most relevant product categories for health impact

Once you’ve established the right mindset to reach low-income consumers with nutritious foods, the next question – whether you are a company, an NGO or a donor looking for health impact via nutrition – is how to choose the best-suited product to achieve these goals in the local market you’re serving.

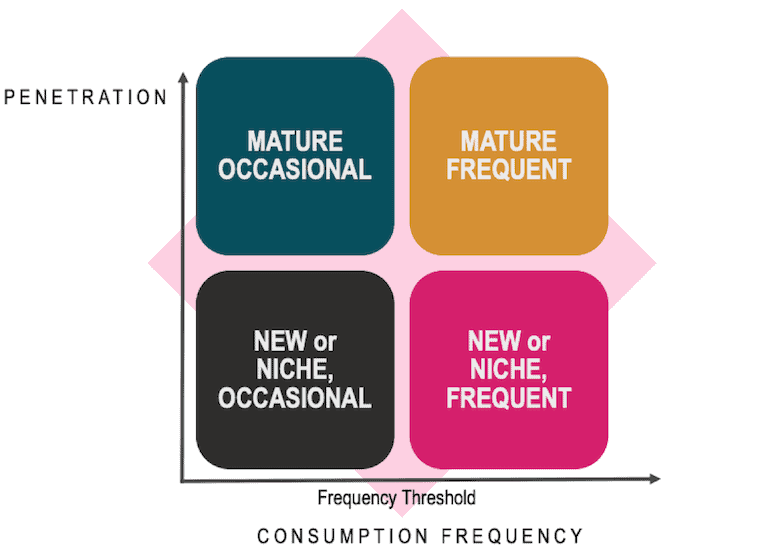

To that end, it is useful to consider two key product characteristics, as illustrated in the matrix below:

- Penetration: Is the product already purchased by most consumers? If so, this product’s market should be considered mature. If not, the product is either niche (i.e., it caters to a specific population segment, such as soy milk) or new (i.e., it is currently at the beginning of its expansion).

- Consumption frequency: Do typical consumers use the product frequently enough to lead to positive health outcomes? In most cases, nutritionists assume that products will be consumed daily or every other day in determining the dosage of fortification that is sufficient to tackle nutritional deficiencies in a target population.

Adopting the right strategic approach to market a product: the opportunity selection tool

Public efforts to provide micronutrients via large-scale food fortification always select established products that are widely consumed across the population – the top right category in the matrix above. Basic products like salt, flour or oil are already a local staple, and little effort will be necessary to encourage consumers’ adoption of a fortified version.

Food companies that do not have such regularly used staples in their portfolio would need to select products that already offer a competitive advantage – for example:

- A product with high existing penetration (i.e., one located in the top left category of the matrix, “mature occasional”). Such products will require dedicated marketing efforts to anchor the product into habits, using consumption frequency tactics such as the ones proposed in Tool 4 below.

- A product with high existing consumption frequency (i.e., one located in the bottom right category of the matrix, “new or niche, frequent”). This is typically where vegan alternatives to traditional staples would be. These products must be repositioned so that they become appealing to a larger number of consumers.

Companies may be tempted to fortify new product lines rather than existing ones (to avoid jeopardizing their current business), and donors and NGOs have often tried to launch new “silver bullet” products designed by nutritionists. But these products, which sit at the bottom left of the matrix, can only achieve minimal health impact, at least initially. They will require their promoters to invest very heavily in market-building to move their product from the bottom left corner to the top right one, if they hope to make a difference.

Ideas for relevant marketing strategies depending on where products stand on this matrix are detailed in this webinar based on the Consumption Frequency Toolkit.

Tool #3: Identifying where your consumers stand in their adoption journey

In order to become frequent and loyal consumers, your consumers need to go through several steps. The first one is a successful trial of the product, i.e., having a first positive experience. The second one is to purchase the product frequently enough for it to deliver its expected impact over a short period of time. Consumers can then experience some health benefits (e.g., feeling more energized, etc.) that motivate them to keep using it. The final stage is when the product has fully entered the consumer’s habits over time, resulting in not just frequent but also loyal consumers – and products that deliver benefits in the long term.

Where do your consumers stand on this journey to first trial, consumption frequency and brand loyalty? And what might be some compelling arguments to move them along this journey? This third tool is comprised of a series of primary research interview guides meant to help impact-focused organizations identify persuasive selling points and effective marketing tactics to maximize consumption frequency. They include questions like:

- What are target consumers’ aspirations in using the product?

- What behaviors around food do they repeat daily or for each meal?

- Who and what convinces them to purchase a product or to try something new?

The Danone team in Nigeria used these tools when they were defining the communication strategy around the new fortified option of their FanMilk frozen yogurt, FanPrime. The resulting data led the team to choose to leverage a women direct sales force in local markets to push consumption frequency among women consumers, for whom the product fortification profile was designed. Five months after launch in Lagos, over 50% of these saleswomen’s female clients were consuming the product frequently (at least several times per week).

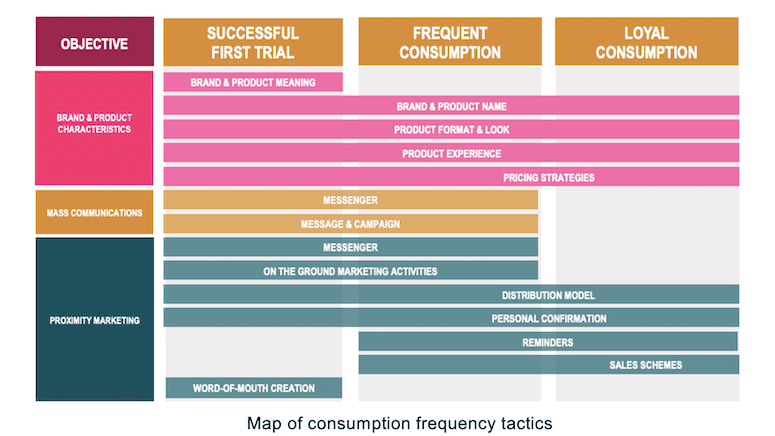

Tool #4: Seeking inspiration from proven tactics to increase consumption frequency

What behavioral science techniques and marketing and distribution tactics can companies use to further push consumption frequency? The last tool of the Consumption Frequency Toolkit is a comprehensive library of 54 tactics around 14 broad themes presented in the chart below, classified as those that relate to brand and product characteristics, mass communication, and proximity marketing. Companies can select the most relevant themes by using insights gathered with Tool 3, then use Tool 4’s ready-made slides (from slide 64 onward at the end of the toolkit) in ideation workshops to design the most effective distribution and marketing approaches for their own brand.

A few examples and use cases of these 54 tactics include:

- Expressing brands’ and products’ characteristics through their names: Nutriset named its fortified spread for pregnant and lactating women “Growell Mum” to highlight the benefits for the mother and her child. This also works for unbranded nutritious products: For instance, the Australian banana industry reframed bananas as “nature’s energy snack” to encourage people to replace snack bars with a banana.

- Using “anchoring” for mass communication: By setting an aspirational consumption target and “anchoring” it in the mind of consumers, the U.K. government’s “Eat 5 a Day” campaign for fruits and vegetables pushed people to choose fruits and vegetables more often than they had previously done, even if they did not achieve the five-per-day target.

- Using reminders in proximity marketing. Nutri’zaza sells its fortified porridge ready-to-eat during daily morning tours in the lower-income areas of Antananarivo, Madagascar. These morning tours, which always follow the same route, help create a habit of daily consumption among local children, while driving sales in surrounding shops where the product is also distributed.

If you’re keen to learn more on this topic, the Consumption Frequency Toolkit is part of a body of knowledge developed by the Growth for Growth team to make beneficial fast-moving consumer goods affordable, accessible and aspirational for all.

We hope that these four tools will help organizations selling beneficial products to efficiently achieve their consumption frequency goals, and positively impact the people who need their products the most.

Note: This article is based on research funded by the Bill & Melinda Gates Foundation. The findings and conclusions contained within are those of the authors and do not necessarily reflect positions or policies of the Bill & Melinda Gates Foundation.

Lucie Klarsfeld McGrath is a Partner at Hystra and co-founder of the Global Distributors Collective; Louise Berthault is a Consultant at Hystra.

Photo courtesy of ILO Asia-Pacific.

- Categories

- Health Care, Social Enterprise