Nine Business Models for Productive Use of Electricity in Africa: A Framework for Generating Profit and Impact in Off-Grid Energy

In rural fishing communities in Nigeria, lack of access to grid electricity forces fishers to rely on traditional methods of storage for their catch, like sun-drying, salting and smoking. These limitations force them to quickly sell their fish at low prices — and they still lose up to 20% of their catch from spoilage. Across the country, farmers face similar problems in crop production and livestock rearing.

Like these farmers and fisherfolk, over 90 million Nigerians lack access to electricity from the main grid and another 30 million get less than four hours of grid electricity per day (as of 2019). Improving power infrastructure access and reliability in these communities is crucial for poverty reduction, but rising poverty levels limit grid electricity’s affordability. And for these households, affording off-grid options — even when they are accessible — also presents a challenge.

Productive Use of Electricity (often called “Productive Use” or “PUE”) has the potential to break this vicious cycle. Individuals who use electricity for productive uses — i.e., to power income-generating equipment — can grow their household incomes and stimulate economic activities across their communities. These higher levels of household income and economic growth will improve the ability of community members to afford off-grid solutions, while also increasing profitability for off-grid energy providers.

The potential of PUE is well known to off-grid energy companies working in Africa, with several piloting PUE initiatives in the communities where they operate. To support their efforts, CrossBoundary has developed a framework that can be applied broadly by these companies and other stakeholders to help them adequately plan for PUE implementation. We’ll explore the various elements of this framework below.

Productive Use Assessment Framework

A PUE business typically starts by identifying which economic activities or value chains within a community are suitable for electrification, and determining which business models can provide this electricity access profitably. To that end, our PUE Assessment Framework is built around these two fundamental elements of a successful PUE strategy:

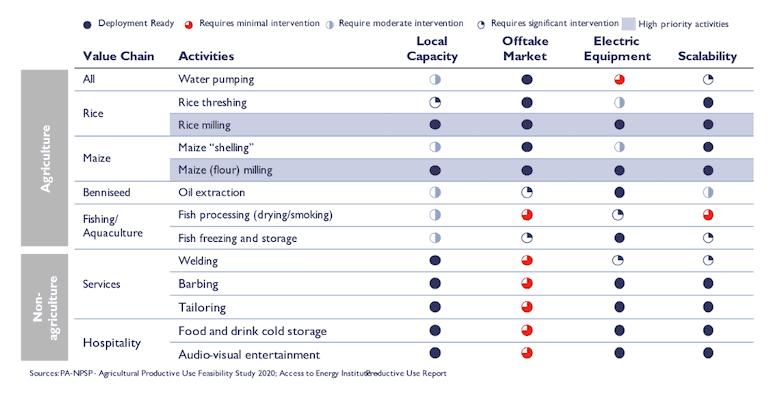

1. Assessing Economic Activity: This involves identifying economic activities with the potential to be prevalent within the community — from food production and processing, to services like woodwork or hospitality — and assessing their suitability for electrification. This assessment can be done using four criteria defined by the Power Africa – Nigeria Power Sector Program in 2020:

- Local capacity: This refers to the experience local community members have with specific mechanization activities and/or electrical equipment, and how easy it would be to upskill community members to operate and maintain these assets.

- Access to offtake markets: This involves the accessibility of markets/customers — i.e., whether they are willing to pay enough for the proposed electrification outputs/services to ensure profitability for stakeholders.

- Accessibility of suitable electric equipment: This refers to the existence of accessible electrical equipment that provides performance and reliability advantages over non-electrical alternatives.

- Scalability: This refers to the ability to roll out a certain solution to multiple customers or communities — either within the region or across the off-grid energy provider’s network. Activities within high-volume value chains that are primed for deployment can be scaled more efficiently than those within niche value chains with specific prerequisites for success.

Figure 1 below shows a sample assessment of the electrification potential of typical economic activities in an agrarian community in Northern Nigeria.

Figure 1: Electrification readiness assessment of typical rural economic activities

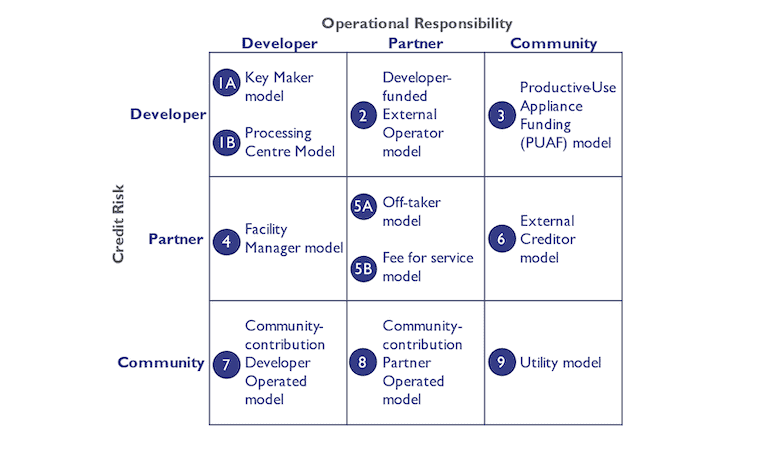

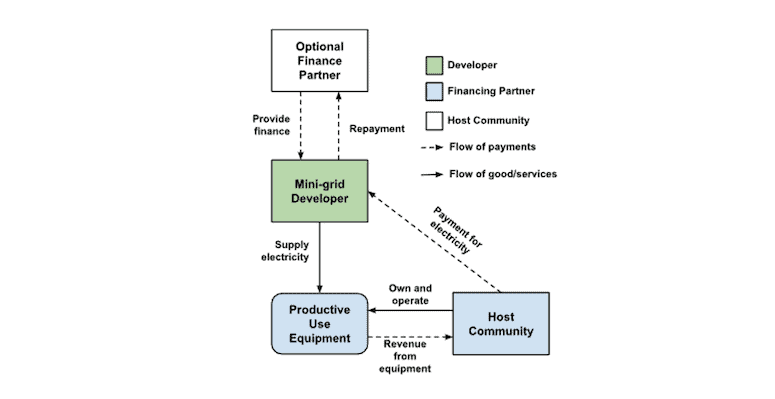

2. Designing Productive Use Business Models: This involves choosing a business model and allocating its operational responsibilities (i.e., the party that operates the PUE equipment and earns operational income from it) and credit risk (i.e., the party financing the asset and likely to bear the loss in the event of a default) across three groups of stakeholders. These stakeholders include off-grid energy providers (often referred to as “developers”), the host community, and any third-party partners who finance and/or operate the PUE asset.

Implementers of PUE initiatives must select their preferred business models based on the developer’s capabilities, the availability and capability of any operating and financial partners, and the developer’s risk appetite and other defined priorities. CrossBoundary has defined several PUE business models in Figure 2 below, assigning operational responsibility and credit risk to either the community, the partner(s) or the developer. We’ll describe these different models below.

Nine Business Models for Productive Use

Figure 2: Business Model Options for Productive Use

Developer-operated, developer-financed models

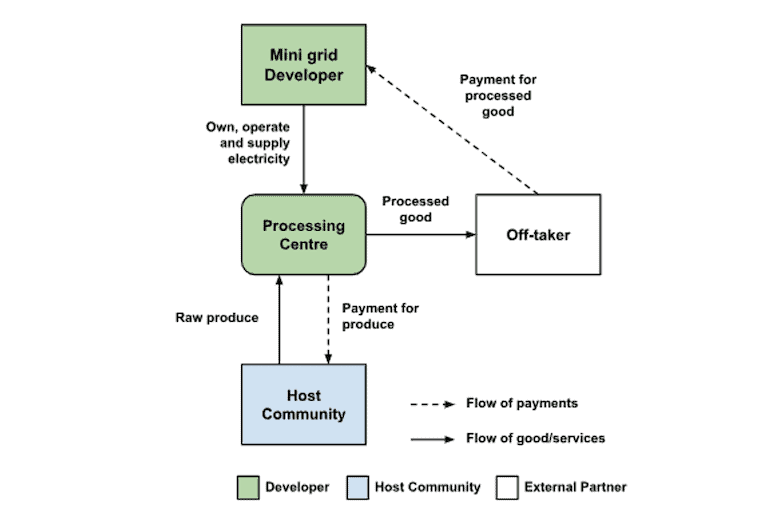

1A. Key-Maker Model: Described by Sustainable Energy for All and the African Development Bank in 2019, this model requires the developer to own the processing center, the produce and the processed goods. The developer purchases raw produce from the community to process and sell to an off-taker, thereby leveraging cost and operational synergies for mini-grid and processing facilities (see Figure 3 below). This model requires a dependable off-taker, additional financing the developer may need to invest in the processing facilities, and a developer willing and able to diversify into a line of business that is potentially different from their core expertise. In 2018, the mini-grid developer JUMEME in Tanzania became an early adopter of the Key-Maker model, collecting fish from local fishers on the shores of Lake Victoria and processing then deep-freezing the fish on site using its mini-grid electricity. The fish are purchased and shipped to urban centers by JUMEME’s partner.

Figure 3: Key-Maker Model

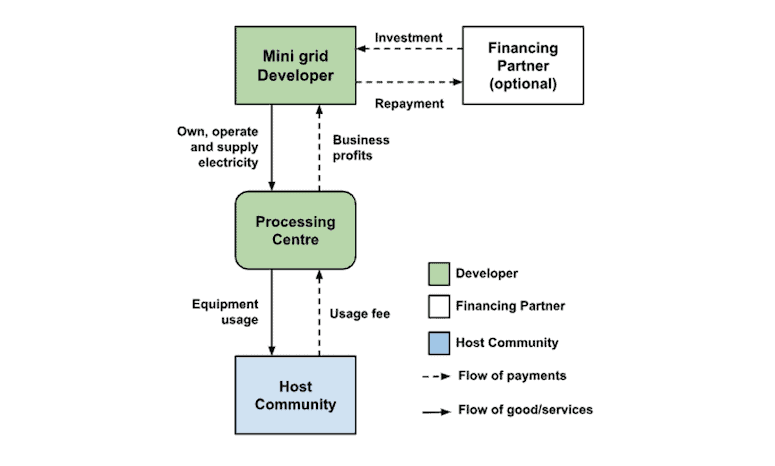

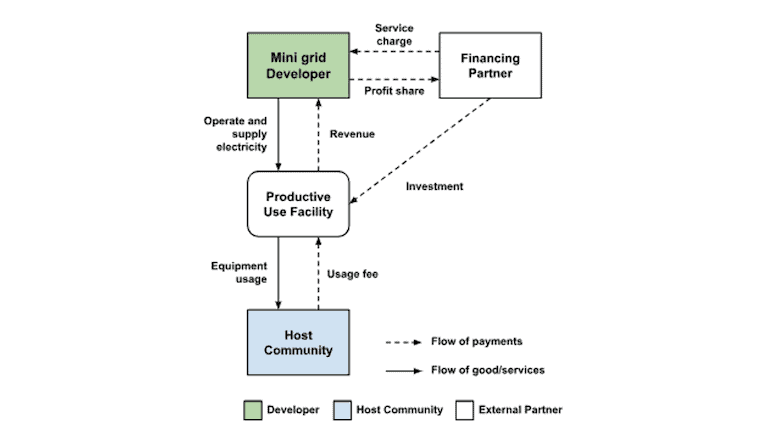

1B. Processing Center Model: By running a Processing Center, the developer provides services in addition to electricity to the community in return for usage fees (see Figure 4 below). This provides additional sources of income to both the developer and the community — however, it requires a proven demand for the finished goods within the community.

Figure 4: Processing Center Model

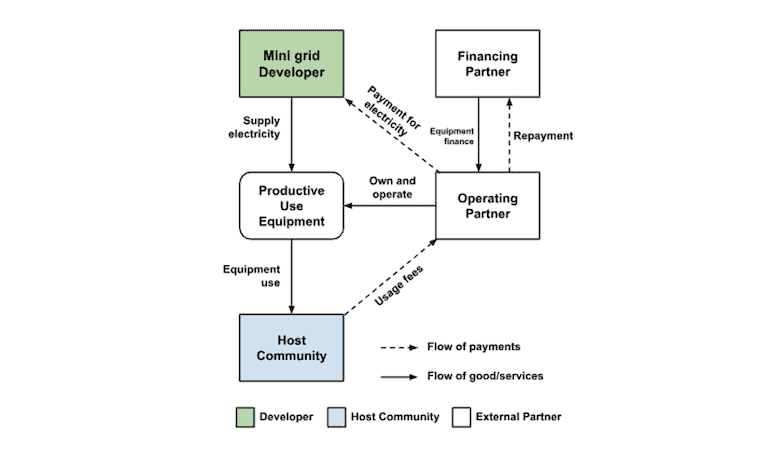

2. Developer-funded, external operator model: In this model, the developer invests in PUE equipment and partners with an external actor (typically another business) to operate the equipment. This allows the developer to raise additional income from fees paid by the operator and increased electricity demand, yet also removes the responsibility for operating a non-core business model. A competent partner with community relationships and excellent operations management is essential for this model’s success.

3. Productive Use Appliance Financing (PUAF) Model: This is the most common PUE model and the easiest to implement. It requires the developer to finance the procurement of PUE for use by individual members of the community who engage in productive use activities. These individuals will usually pay for the equipment in installments. This model has the advantage of being flexible, as the developer can choose to only procure equipment as requested by members of the community. Success in PUAF requires that the developer have a framework to manage the creditworthiness of community members who request appliance financing, and that these individuals have the competence to operate the PUE equipment. Unlike some of the other models discussed here, PUAF typically does not directly create new markets or industries.

Figure 5: Productive Use Appliance Financing Model

4. Facility Manager Model: This model requires that the developer use its operational expertise to serve as a facility manager for investments by partners. The partners finance a PUE asset and contract the developer to operate it for the benefit of the community. The developer may charge individual community members for the use of the asset, or the partners may provide philanthropic funding to the developer that enables the community to use it for free. In either case, this provides the developer with an anchor load (i.e., a customer with a continuous, predictable and sizable demand for its electricity) and additional revenue with limited developer risk. For example, developers can operate processing facilities in local communities for large farming businesses, or serve as implementing partners for donors and development finance institutions (DFIs) interested in investing in infrastructure in rural communities.

Figure 6: Facility Manager Model

Partner-operated, partner-financed models

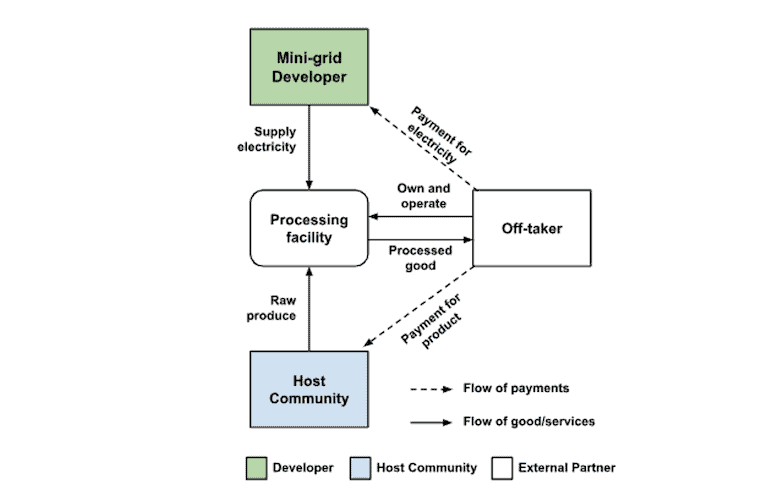

5A. Off-taker Model: This model requires a partner — in this case, an off-taker of agricultural produce — to invest in and operate processing facilities within host communities. Community members take raw produce to the processing center, where it is purchased and processed by the off-taker. This model benefits the community by creating a guaranteed market for specific (typically perishable) local produce, and benefits the off-taker by providing them with a guaranteed supply of produce to sell. Successful off-takers are typically large organizations with financial strength and operational expertise (e.g., Arla Foods uses the off-taker model in a partnership with the Kaduna State government in Nigeria to produce milk). The developer provides energy for the processing facilities, benefiting from the increased consumption of electricity and increase in community income (which also leads to more local demand for its electricity).

Figure 7: Off-taker Model

5B. Fee-for-Service Model: This model also requires external partners to both operate and finance the PUE equipment. But in this case, the external partners who invest in and operate the PUE facilities in host communities have no off-take responsibility. They operate the facilities in exchange for usage fees paid by community members, with the developer merely providing power to the facility. This model increases electricity consumption and developer income, and like the Off-taker Model above, it requires the developer to take no additional credit or operational risk.

Figure 8: Fee-for-Service Model

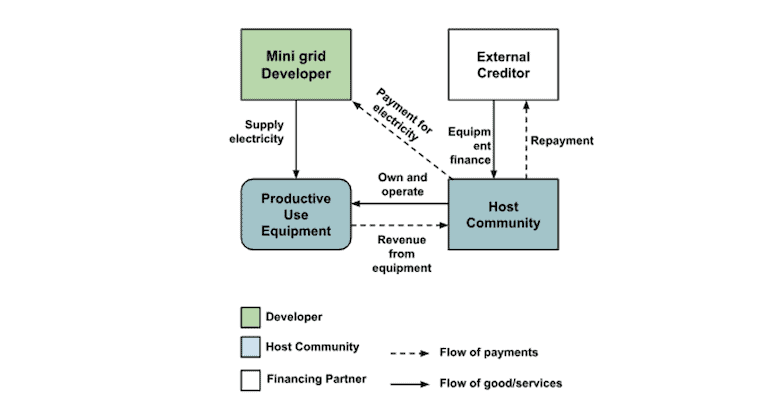

External Creditor Model: This model is an externally financed version of Productive Use Appliance Financing. But instead of the developer financing the procurement of PUE equipment for use by the community, a partner provides this financing. This model is similarly flexible and exposes the developer to no additional credit or operational risk, while providing benefits from the increased consumption of electricity and increase in community income. However, it can be challenging to find capable financing partners willing to take risks on the creditworthiness of rural community members.

Figure 9: External Creditor Model

7 – 8: Community-contribution models: In these models, members of the community finance a PUE project and agree with a developer or a third-party partner to operate it on behalf of the community. This could be applicable in scenarios where operational synergies exist between the PUE equipment and the mini-grid facility, or if specific expertise is required to operate the PUE facility.

9. Utility model: This is the default model requiring no intervention by the developer or other partners. The PUE equipment is entirely financed and operated by members of the local community. The developer is only responsible for supplying electricity to the equipment.

A Framework for Business Model Prioritization

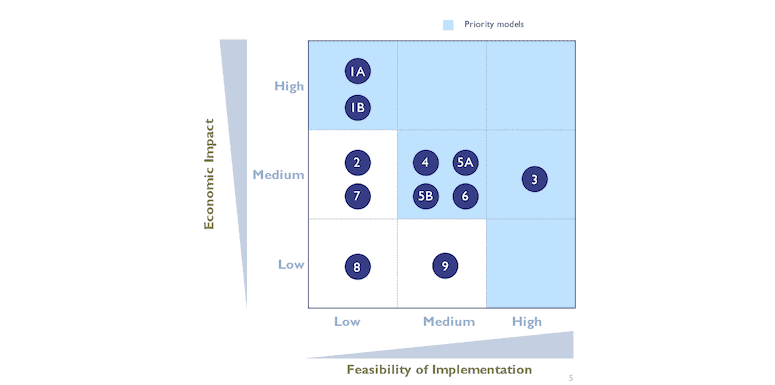

CrossBoundary has also provided a framework for prioritizing business models, on the basis of their potential for economic impact and the expected feasibility of implementation (see Figure 10).

Economic impact refers to value created by the business model, both in terms of increases in host community income and additional revenue opportunities for the mini-grid developer. Feasibility of implementation considers the existence of partners and the amount of effort and costs required to implement the business model. Generally, it is easiest for developers to implement models that require less involvement from them.

Figure 10: Business Model Prioritization

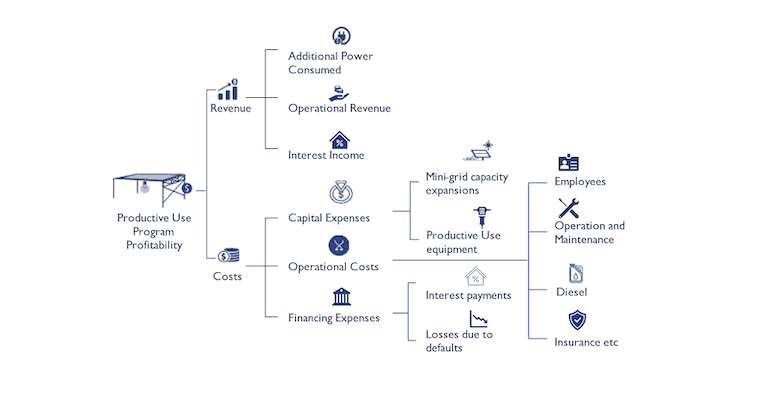

It is essential to assess the financial impact of any PUE business model under consideration to ensure that the uplift in revenues makes up for additional costs incurred. The following graphic outlines the various cost components and revenue streams that are associated with a typical PUE program.

Figure 11: Key considerations for productive use profitability

Recommendations for deploying Productive Use

Subject to strategic preferences, implementers of PUE initiatives should typically prioritize financing PUE appliances themselves (the PUAF model) in the short term before partnering with financiers and other operators to implement more complex models that involve developing enterprises within host communities.

Learnings from prior programs must also guide future initiatives. Active PUE initiatives should gather data on community needs, requested PUE equipment, ongoing program impact on power consumption and mini-grid profitability, default rates on repayments, electricity bills, and customer income growth. Insights generated from this data should guide decision-making by stakeholders.

Finally, relationships with partners to provide equipment and financing or offtake produce from host communities are essential to scaling whatever solution is ultimately implemented.

The Impact of Productive Use Deployment

Developers and their partners in the private and public sectors are implementing Productive Use of Electricity initiatives in rural communities across developing countries.

An example is the pilot initiative of the Rural Electrification Agency and Rocky Mountain Institute under the Energizing Agriculture Programme. This pilot, implemented by Husk Power in Kiguna, Nasarawa, Nigeria, adopts the off-taker model in a solar mini-grid-powered cold room partnership with ColdBox Store. ColdBox Store processes and resells up to 3,000 kilograms of fish weekly, providing an additional 20 cents profit per kilogram for local fishers.

In conclusion, the thoughtful deployment of PUE initiatives has the potential to boost revenue for local communities. This improves their ability to pay for off-grid solutions, directly impacting developers’ revenue models. These initiatives can be applied across the entire agricultural value chain, including transportation and processing, generating significant value for the project developers, financiers and other stakeholders.

If you are interested in learning more about how to implement PUE projects and business models, please contact the author at olowo.aminu@crossboundary.com. We would love to hear from you and share insights and resources.

NOTE: This article has been edited and condensed for publishing on NextBillion. The full version will be available on CrossBoundary’s website shortly.

Olowo Aminu is an Associate Principal, Bodunde Akinola is an Associate Principal, Nneka Chime is a Partner, and Mosorire Aiyeyemi is a member of the CrossBoundary Nigeria Advisory Team.

Photo courtesy of Maheder Haileselassie / IWMI.

- Categories

- Agriculture, Energy, Environment, Technology